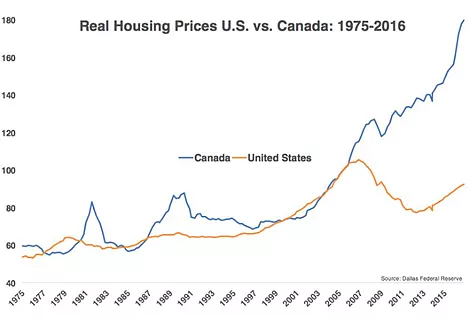

The chart shows real house prices in US vs Canada from the period 1975-2016. Taking a long time period is always good practice, as is inflation adjusting price series such as these. The one caution I would remark on is setting your base period (i.e. where you rebase the indexes), as it can sometimes mislead. But there is clearly something going on here, and Canadian house prices have moved materially higher than that of the United States. Carlson notes in the article that it looks like a bubble – and a much bigger bubble than that which the US went through, and while the bursting of a bubble can be hard to predict Canadians should be on “avalanche alert”.

Now, for the second part of the ChartCritic – where we add our own chart to the mix. I had a play around with a few different datasets, first the BIS real property price series, some national nominal property price indexes, and then finally the OECD housing market valuation indicators. It’s worth looking at valuation because it can give greater insight than price alone – if price surges 10 fold, but incomes surge 20 fold it’s an entirely different conclusion than if you just look at prices surging 10 fold. The chart I present shows combined price to rent and price to income ratio valuation indicators from the OECD database for the 3 countries in the commodity dollar bloc. And the interesting thing is, besides all calling their currencies “dollars” and having a bigly part of their economy driven by commodities, they all have grossly overvalued housing markets.

Carlson’s chart shows a long term picture of real house prices in America and Canada and the conclusion that Canada is in a housing bubble smacks you in the face.

Besides all having the word “dollar” in their currency and deriving significant income from commodities, the commodity dollar bloc countries have tremendously overvalued housing markets. (note, the same indicator for America was at 102 in the latest reading) (also note the indicators show valuations vs history rather than absolute valuation levels – so we are comparing the degree of over/undervaluation, not relative value).

Leave A Comment