One of the greatest traders of all time, yet probably one of the least well known, once said, “win or lose, everybody gets what they want out of the market.” Easy for Ed Seykota to say as he sits on his deck overlooking Lake Tahoe sipping a nice California cab. Yet as I struggle to make sense of this great game we all love to play, I wonder if maybe Ed is correct. I know his comment might seem a little preachy, but the older I get, the more I realize that a trader’s biggest obstacles lie in the dark recesses of their thoughts, not in the day-to-day zigs and zags of the markets.

So I wonder. Not only do we all get what we want, but do we only see what we want to see?

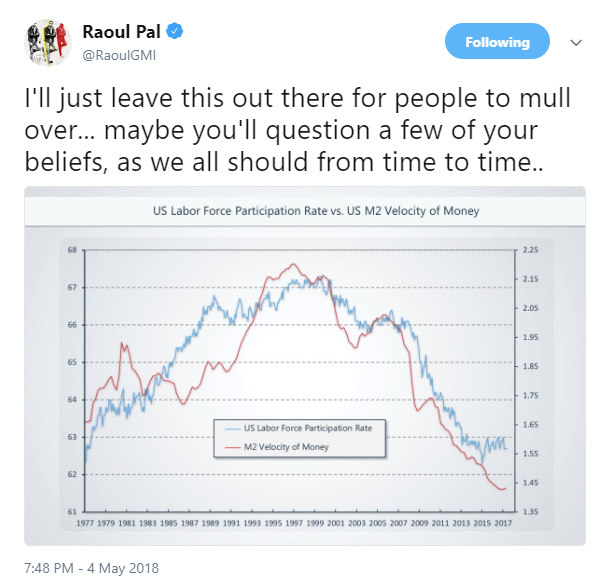

The other day, one of the biggest bond bulls out there posted the following chart:

I was confused by Raoul’s comments because as I examined the chart of M2 Money Velocity versus US Labour Force Participation, it only made me more bearish on bonds. But to Raoul and all the other deflationists, this chart demonstrates the futility of battling the overpowering forces of demographic deflation.

Before we go any further, I am about to commit the cardinal sin of trading – mixing timeframes. Bonds are hugely oversold on shorter-term charts and everyone is leaning short. It wouldn’t take much of an economic pause to cause a massive short covering rally. Therefore I am by no means advocating leaning hard on bonds down here for a trade.

Yet as an investment, bonds are a terrible risk-reward. And ironically, Raoul’s chart provides the reason.

Let’s assume that monetary velocity is affected by labour participation. Not a hard leap to make. The more people that are working, the more likely they are to borrow and spend.

But what has happened to labour over the past couple of decades? With the fall of the Iron Curtain, combined with China’s WTO admission, and topped off with a demographic bulge of baby-boomers, the global economy has been subject to a massive labour supply glut. This has driven down the cost of labour as a percentage of GDP to multi-generational lows:

Leave A Comment