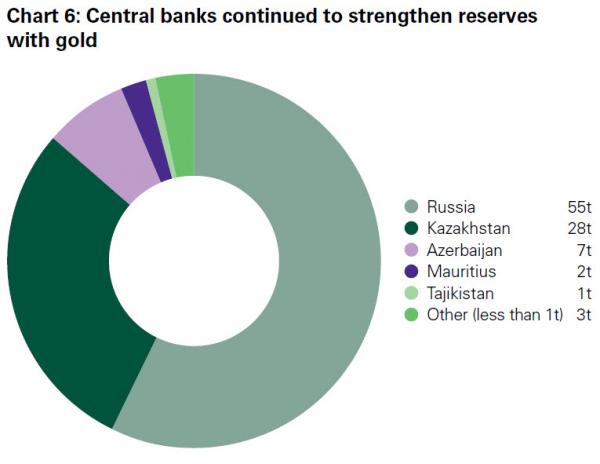

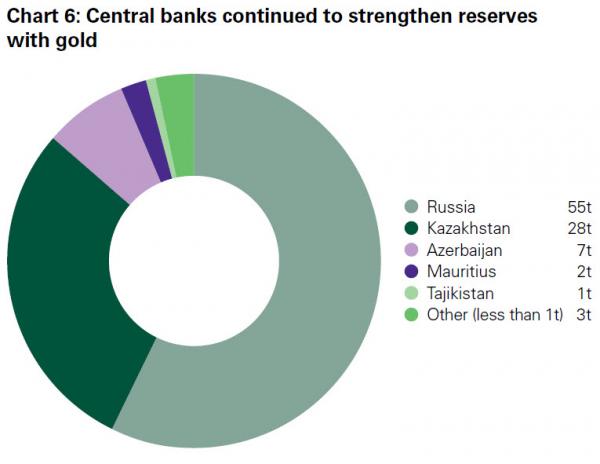

Just as China is buying ‘cheap’ oil with both hands and feet, so Russia, according to the latest data from The World Gold Council (WGC) has been buying gold in huge size. Dwarfing the rest of the world’s buying in Q3, Russia added a stunning 55 tonnes to its reserves, as The Telegraph reports, Putin is taking advantage of lower gold prices to pack the vaults of Russia’s central bank with bullion as it “prepares for the possibility of a long, drawn-out economic war with the West.”

Bottom line: Russia bought more gold in Q3 then all other countries combined (of course, nobody know what or how much China is buying).

The Telegraph reports

Vladimir Putin’s government is understood to be hoarding vast quantities of gold, having tripled stocks to around 1,150 tonnes in the last decade. These reserves could provide the Kremlin with vital firepower to try and offset the sharp declines in the rouble.

Russia’s currency has come under intense pressure since US and European sanctions and falling oil prices started to hurt the economy. Revenues from the sale of oil and gas account for about 45pc of the Russian government’s budget receipts.

In total, central banks around the world bought 93 tonnes of the precious metal in the third quarter, marking it the 15th consecutive quarter of net purchases. In its report, the World Gold Council said this was down to a combination of geopolitical tensions and attempts by countries to diversify their reserves away from the US dollar.

By the end of the year, central banks will have acquired up to 500 tonnes of gold during the latest buying spell, according to Alistair Hewitt, head of market intelligence at the World Gold Council.

“Central banks have been consistently adding to their gold holdings since 2009,”Mr Hewitt told the Telegraph.

Leave A Comment