CoinCentral Court: Ripple in the Hot Seat

As the number three cryptocurrency by market cap, it’s impossible for Ripple (XRP) to escape the limelight. With rumors of bribing exchanges for listings and a heated lawsuit with R3, it’s easy to see why so many people dislike the project. But, does Ripple deserve the flak it’s been receiving?

In our second edition of CoinCentral court, we put Ripple on trial, breaking down the most substantial claims against the project and coin.

Before we begin, though, we need to clarify something. Although commonly used interchangeably (even sometimes by us), Ripple is not the same as XRP. RippleNet is the blockchain network created by Ripple Labs, a company. And, XRP is a digital asset on RippleNet.

For the sake of this article, we’ll be referring to the Ripple Labs company as Ripple, the blockchain network as RippleNet, and the cryptocurrency as XRP. Now that that’s out of the way, let’s dive in.

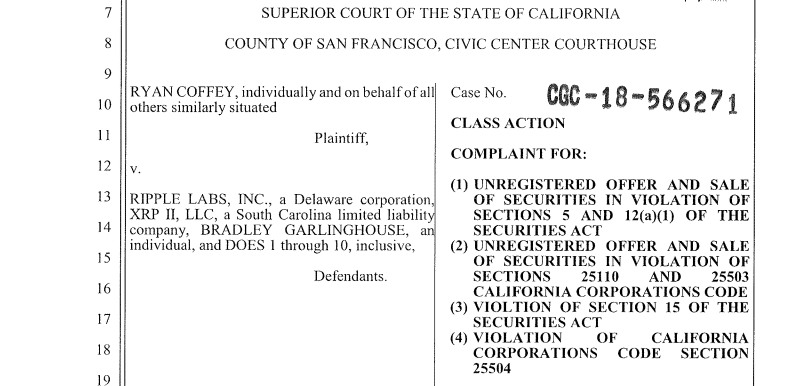

Case #1: XRP is an illegally sold security.

Evidence

Lawsuit after lawsuit seem to be popping out of the woodwork in an attempt to take Ripple to (actual) court regarding XRP’s status as a security. The lawsuits claim that Ripple CEO Brad Garlinghouse and his team sold XRP to investors as an unregistered security in the United States. The prosecutors argue that “XRP purchasers reasonably expected to derive profits from their ownership of XRP and defendants themselves have frequently highlighted this profit motive.”

While Ripple Labs claims that XRP is a utility token, that may not be the case. Financial institutions aren’t required to use XRP to participate in the RippleNet ecosystem. Instead, “banks and payment providers can use the digital asset XRP to further reduce their costs and access new markets.” So, although XRP can have utility, it’s classification as a security token is really in a gray area.

Furthermore, Ripple consistently markets and promotes XRP outside of its intended use. The company website has a section devoted to an XRP Buying Guide, and the official Twitter account touts new exchange listings. Additionally, the website highlights the market performance of XRP.

If the target market for XRP consists of financial institutions, why is the company aggressively marketing to individual traders?

We’re happy to see $XRP added to @abraglobal‘s new mobile wallet app and exchange and the continued momentum for XRP’s growing global liquidity. https://t.co/Dr7TKrRD31

— Ripple (@Ripple) March 15, 2018

Opponents say this marketing effort stems from a reliance on XRP sales as a revenue generator for the company. They claim that the majority of Ripple’s revenue is currently due to these sales which without the company would flounder. If this claim is valid, then a security classification isn’t so farfetched.

Defense

It should come as no surprise that Ripple and its supporters believe that XRP is not a security. XRP is entirely separate from Ripple, the company. While Ripple is a centralized corporation, XRP is out of the control of any one entity. Even if Ripple disappeared tomorrow, XRP could theoretically still exist.

Ripple also never held an initial coin offering (ICO) to distribute XRP. Instead, the project raised funds from venture capitalists to cover operational costs. ICOs have typically been a red flag to the SEC when it comes to looking at securities. So, with no ICO, Ripple should be in the clear.

Leave A Comment