Chinese Economy Driving U.S. Market

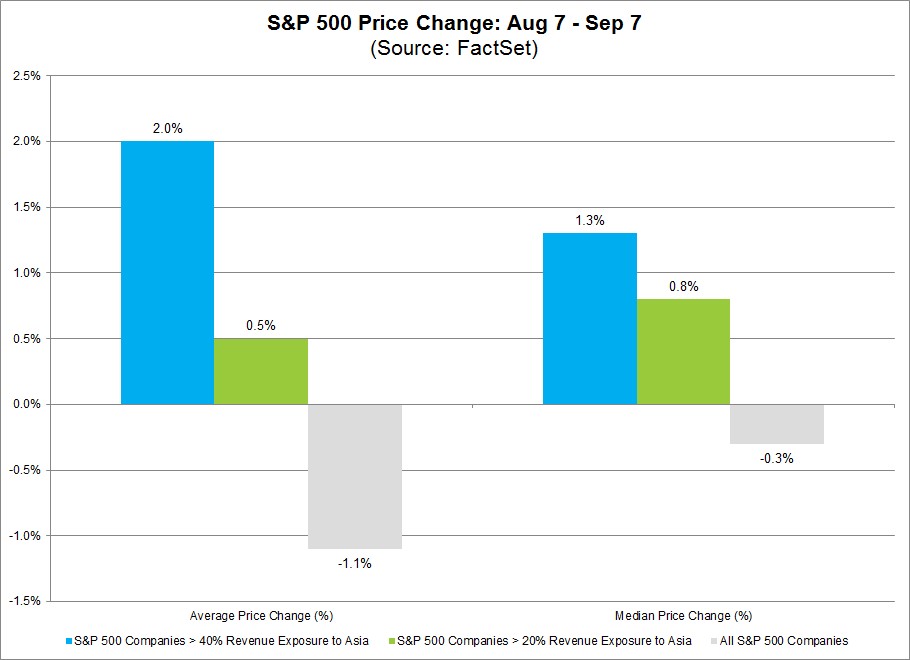

FactSet released its updated aggregate quarterly earnings report. They broke down firms with a large amount of Asian exposure in the chart below. As you can see, the firms with over 40% of sales in Asia outperformed those who only have 20% exposure to Asia. The group with 20% of sales in Asia did better than the entire S&P 500. It would be interesting to see how bad the firms with less than 20% exposure to Asia did. The implication based on these metrics is that group would have even worse performance. This relative performance makes sense based on the improved economic performance of China and Japan. It also shows how weak the rest of the world is. The declining estimate in the GDP Now report is a good representation of American economic weakness.

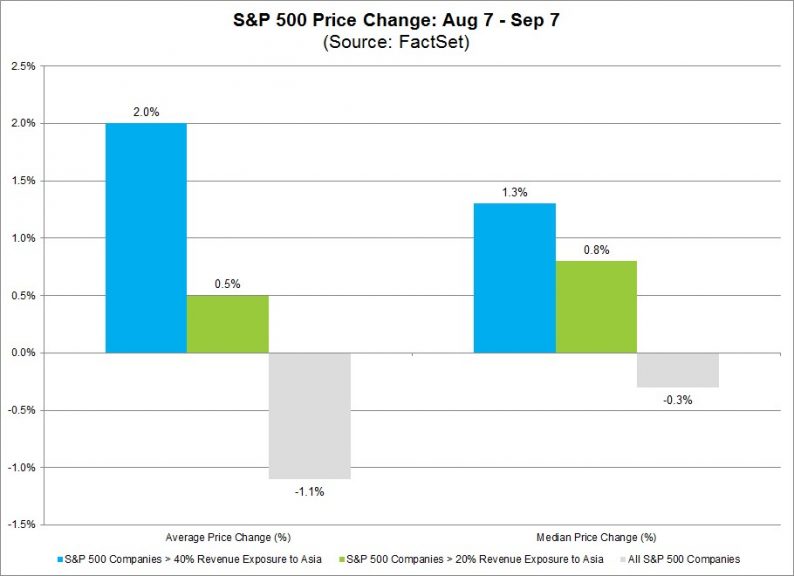

As you can see from the chart below, the Chinese Yuan has had a turnaround. It has been rallying versus the dollar for a few months. The chart above might be slightly biased because in the past few days we’ve seen a minor correction in the Yuan. It’s interesting that the potential nuclear war with North Korea didn’t affect the Yuan or stocks with Asian exposure given that Trump threatened a trade war with China if it didn’t get tougher on North Korea. It shows how the market is ignoring that risk and focusing on the Chinese rebound. With some good economic numbers, analysts are projecting another boom. In August Chinese exports were up 5.5% and imports were up 13.3%. The excavating machinery part of the Chinese Construction Machinery Association stated its excavator sales were up 111.1% year over year in the first 8 months of the year. Industrial profits in were up 21.2% in the first seven month of the year. GDP growth was 6.9% in the first half of the year. After years of deceleration, there’s a renewed optimism that the soft landing is over and a new boom is here.

Q3 Earnings Expectations Crash

Leave A Comment