Only 4.9% YoY Earnings Growth Expected In Q3

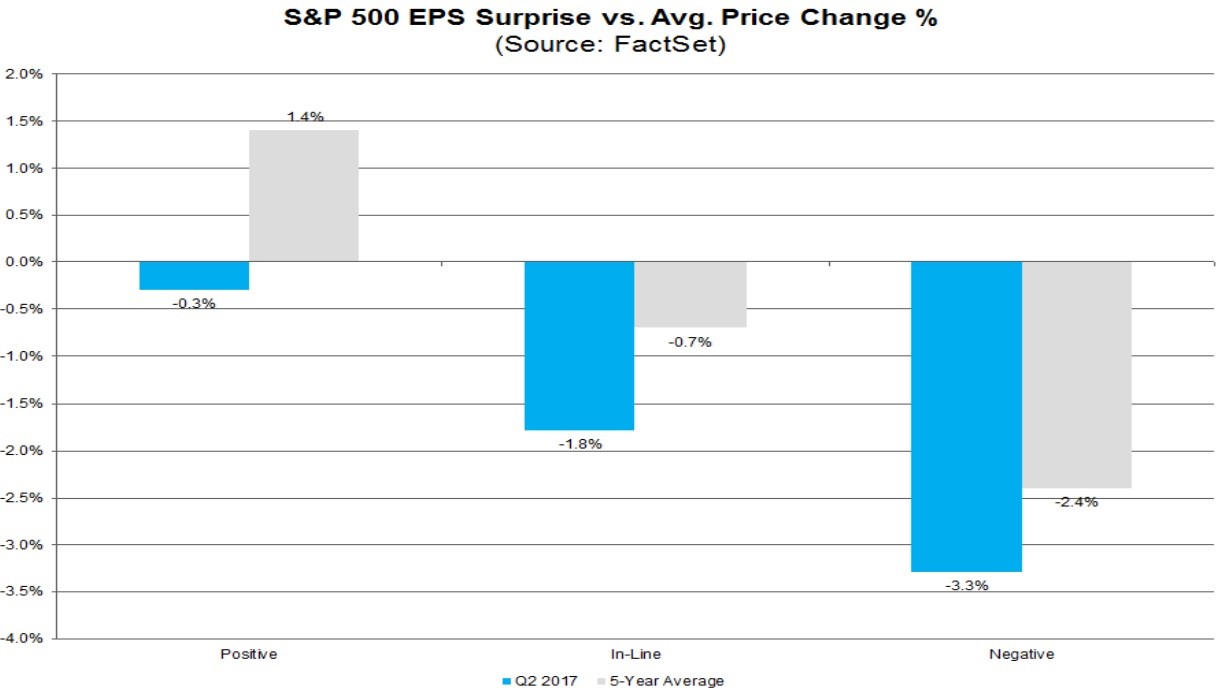

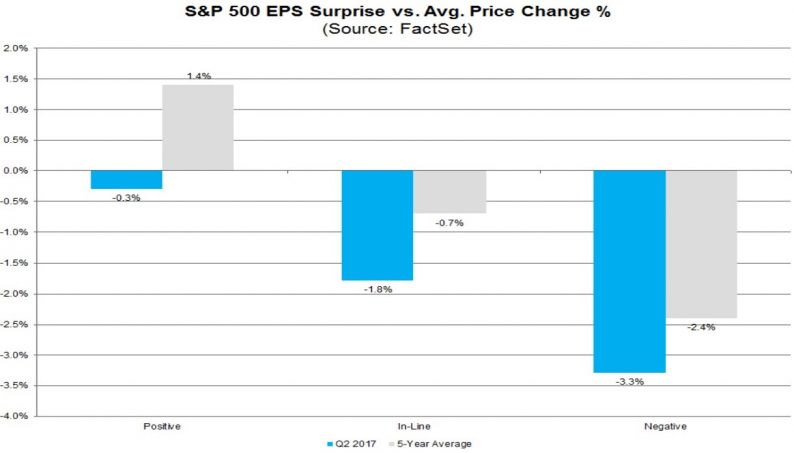

The FactSet weekly earnings presentations resumed this week. As you can see from the chart below, the finalized metrics from the Q2 earnings season show there was a negative bias to every type of report which meant even firms that beat estimates fell. This action was reversed after earnings season as technology and healthcare had the highest beat rates and the best returns in the ensuing few weeks. It seems that this indicator may have been overly hyped to mean something. If you consider that many stocks which beat earnings may have sold off initially and then rallied, does that sound bad? It sounds like initial volatility occurred around earnings and then cooler heads prevailed. This seems to be nothing more than a statistical anomaly.

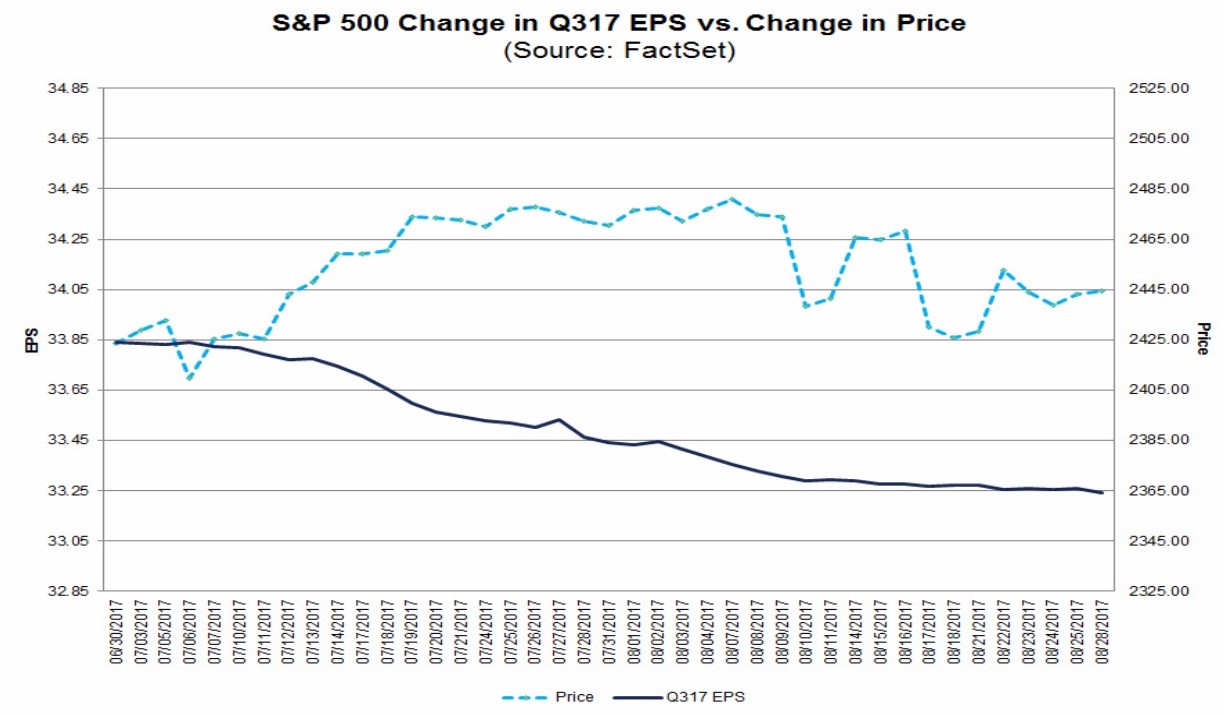

We already know that Q2 was a great earnings season. It’s now time to focus on the expectations for Q3. As you can see in the chart below, analysts have lowered their expectations. According to FactSet, there will only be 4.9% year over year earnings growth. The surprising aspect of this decline is that the percentage of firms issuing negative guidance for Q3 was lower than normal. 62% of the 115 S&P 500 firms issuing guidance were negative. The 5-year average is 75% negative. This analyst negativity is surprising given the weakening dollar. It’s too early to claim this will be a bad quarter because if estimates are beaten more than usual, the quarter can still be salvaged. The numbers are drastically different when looking at the S&P Dow Jones report. They show earnings growth being 15.7% in Q3. That’s only a slight slowdown from the 15.9% growth in Q2. Both reports show growth re-accelerating in Q4 which is because Q4 2016 was relatively weak.

Debt Ceiling Stage Is Being Set

There have been new rumblings on the debt ceiling debate issue as we inch closer to the deadline. It seems as though the ceiling will be reached earlier than mid-October. Treasury Secretary Steve Mnuchin says the deadline is September 29th. He says it can be even earlier than that because of the spending on hurricane relief. Speaking of hurricane relief, as was mentioned in a previous article, FEMA is running short on cash. The leaders in the Senate are trying to attach the Harvey relief spending to the debt ceiling increase. The House already passed a $7.85 million aid package to increase the money FEMA has. The Senate wants to put the debt ceiling issue in that package and send it back to the House. This idea has been floated for a few days. The fact that the House didn’t put the debt ceiling raise in the bill shows how they feel about the concept.

Leave A Comment