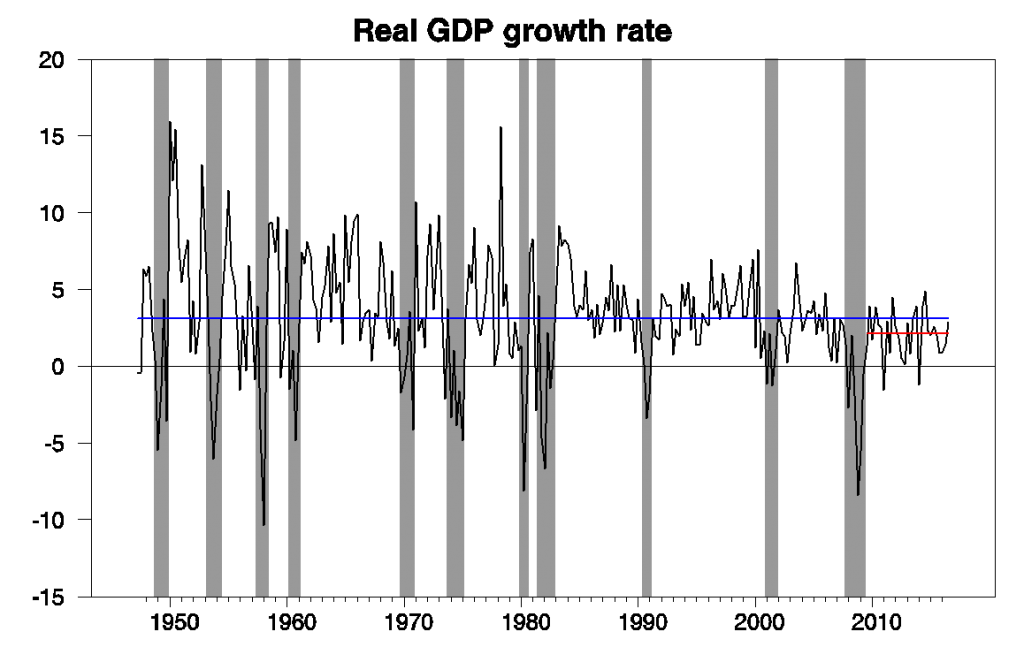

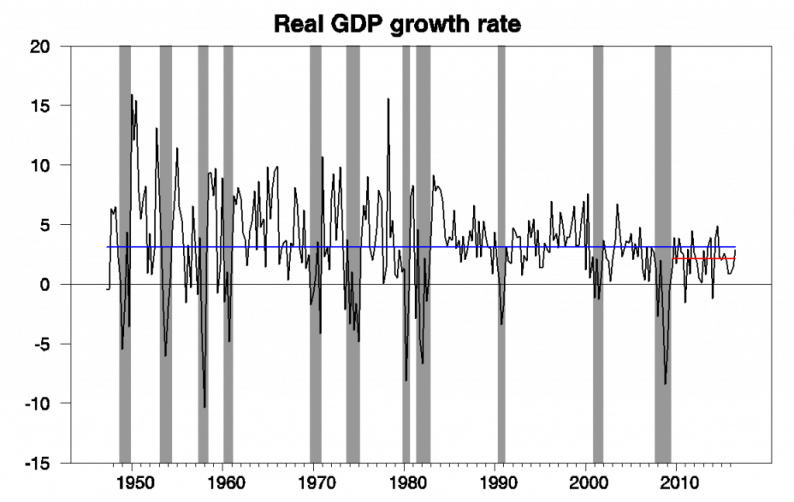

The Bureau of Economic Analysis announced yesterday that U.S. real GDP grew at a 2.9% annual rate in the second quarter. That’s below the historical average U.S. growth rate of 3.1% per year. Even so, this was the best report in the last two years.

Real GDP growth at an annual rate, 1947:Q2-2016:Q3, with historical average (3.1%) in blue and post-Great-Recession average (2.1%) in red.

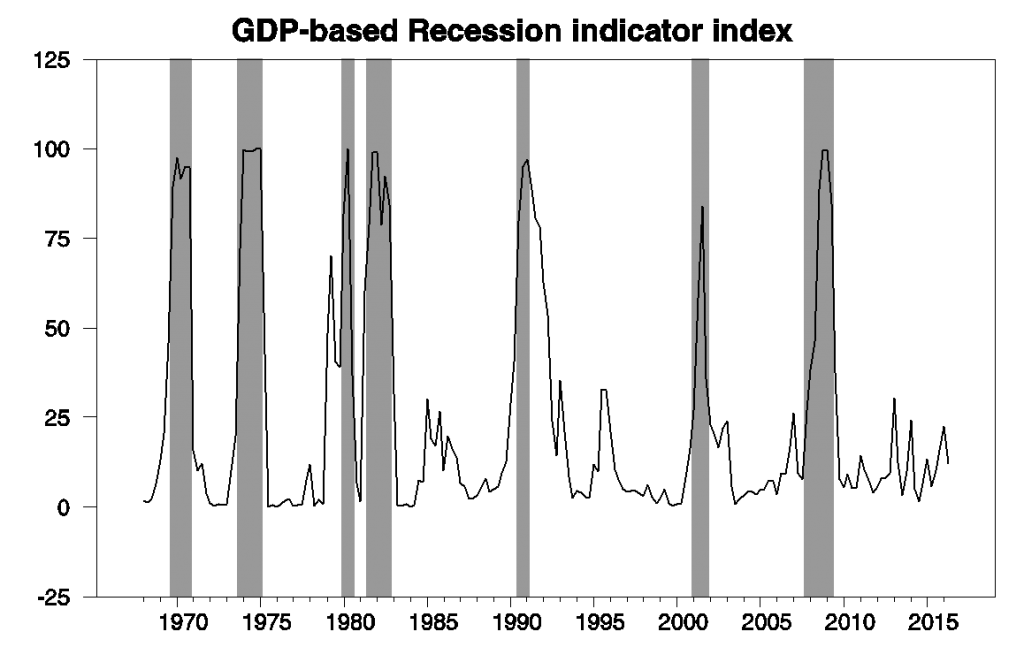

The relatively favorable report brought our Econbrowser Recession Indicator Index back down to 12.2%. The index uses yesterday’s release to form a picture of where the economy stood as of the end of 2016:Q2. The index previously had been somewhat higher due to the earlier string of weaker GDP reports.

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2016:Q2 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

The most important factor in the improvement in GDP growth was real exports. These grew at a 10% annual rate in the third quarter and contributed 1.2 percentage points to the 3.1% total GDP growth. The BEA offered this explanation:

The acceleration in exports was mostly attributable to an acceleration in exports of foods, feeds, and beverages, mainly reflecting an increase in exports of soybeans. This increase in soybean exports was largely offset by decreases in components of nonfarm and farm inventory investment, most notably in merchant wholesale inventories of “farm product raw material.”

The Council of Economic Advisers suggested that U.S. exports in the previous three quarters had been somewhat weaker than was warranted by the observed global economic slowdown, with the Q3 estimate more in line with recent growth rates of our main trading partners.

Leave A Comment