It is indisputable that 2017 has been a challenging year in regards to natural disasters. Hurricane Harvey wrought more than $180 billion in damage to Texas, while Hurricane Maria cost upwards of $95 billion, according to some estimates. With California wildfires raging from north to south and Moody’s now factoring in climate change-related damages into its municipal bond stability forecasts, the stability of the reinsurance industry might now seem in question. But that does not appear to be an issue, according to a December report on insurance stability.

After one of the worst quarters in reinsurance history, 2017 expected to be a largely profitable year

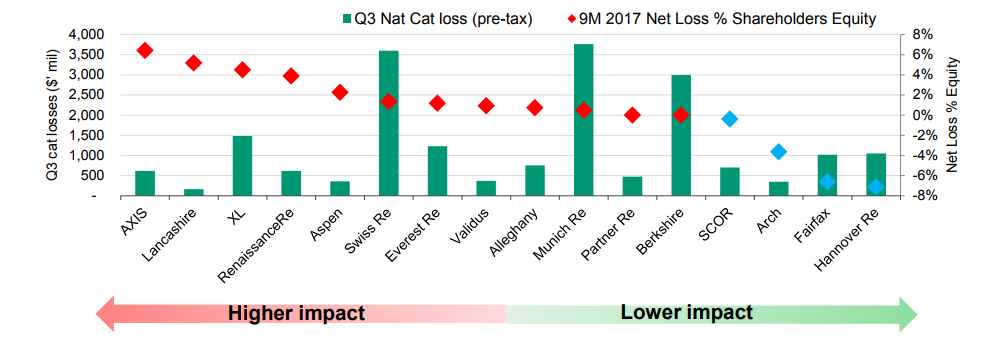

The third quarter of 2017 ranks among history’s worst for large catastrophic losses in the reinsurance industry.

Individual insurers such as Munich Re, Swiss Re, and Berkshire have experienced losses near $3.7 billion, $2.1 billion and $3 billion respectively – and the toll from California wildfires has yet to be fully accounted for. But despite the losses, many of the reinsurance firms are going to remain profitable nonetheless.

In an Outlook Research report, Senior Analysts Brandan Holmes, Sid Ghosh, James Eck and their team review the global reinsurance business and despite the stress see a profitable business model on the year.

“Deteriorating profitability has not significantly diminished returns of capital, with cash returns to shareholders averaging 8.3% of reported equity from 2013 to 2016,” the report noted. “Reinsurers have returned significant capital to shareholders through dividends and share buybacks, although some have indicated capital returns might decrease in the wake of heavy Q3 losses.”

Strong balance sheets and mergers that led to diversification strengthen the Reinsurance industry

What they find are strong balance sheets, good capitalization and moderate leverage as a resiliency towards major hurricane losses. This comes as underwriting has remained disciplined, re-insurers have reduced exposure to catastrophic risks and have largely adjusted to a “new normal” environment where natural disasters are the expected norm.

Leave A Comment