The fourth quarter earnings season for S&P 500 companies is officially wrapping up. The season started out on a sour note in January, with turbulent US markets, currency headwinds, plunging oil prices and a weakening Chinese economy all plaguing the large cap companies, and things only got worse from there.

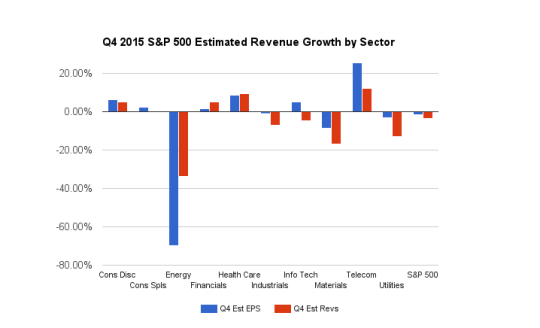

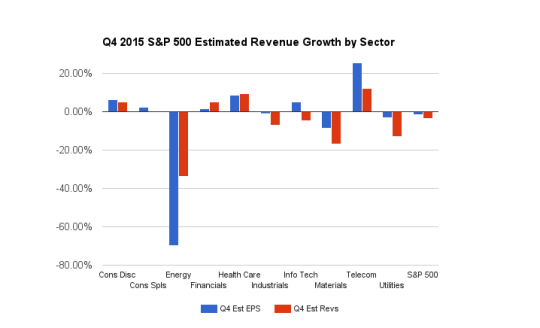

Year-over-year profit growth for the S&P 500 stayed negative throughout the quarter, closing out at -1.8%, with even lower revenue growth of -3.5%. Both of these numbers fell significantly from what was expected at the beginning of the season, with analysts initially calling for negative earnings per share (EPS) growth of -1.4% and revenues of -2.2%. Just taking a look at the beat rates gives us some clues, with only 55% of companies able to beat the Estimize consensus, and an even steeper 41% beating on revenues. Both of these are far lower than historical averages.

Much has been made over the last year of an impending “earnings recession,” ie: three consecutive quarters of YoY profit declines for the S&P 500. However, we haven’t seen a down quarter for EPS since 2009, just barely eeking out of the red last quarter with 0.6% growth. Revenues on the other hand are heading for their fourth consecutive quarter of negative growth, meaning sales growth was technically in recession territory at the completion of Q3 2015. Companies continue to manipulate EPS numbers, but don’t have that same ability on the sales front. It’s a trend that we’ve seen since Q3 2012, meager revenue growth in the low single digits or worse, and it’s certainly cause for concern.

Sector leaders and laggards held fairly steady throughout the reporting season, with Health Care and Consumer Discretionary claiming the top spots, and Information Technology creeping up to third place. On the opposite end, Energy and Materials remain the biggest laggards.

For Health Care, profit growth was recorded at 7.6%, with even higher revenue growth of 8.7%. These numbers crept up during the season on the heels of better-than-expected results. Leading the sector once again was biotechnology, with earnings increasing 19.6% from the year-ago quarter. This high growth industry has seen large capital inflows, and lots of of M&A activity in the past year. The darling of the space, Gilead Sciences, led the pack when they massively beat expectations and continued their multi-quarter trend of double-digit growth on the top and bottom-line.

Leave A Comment