Markets experienced early gains but gave them back by the close of business. Given the mini-rally of the past five days, some of the indices are looking vulnerable to a new round of selling.

The S&P finished with a narrow inverted hammer on low volume but at new highs. A move back to the newly accelerated channel is looking favored.

The Nasdaq also finished with a narrow doji but wasn’t able to make new highs.It’s already close to one channel but looks more likely to reach down to the slower channel.

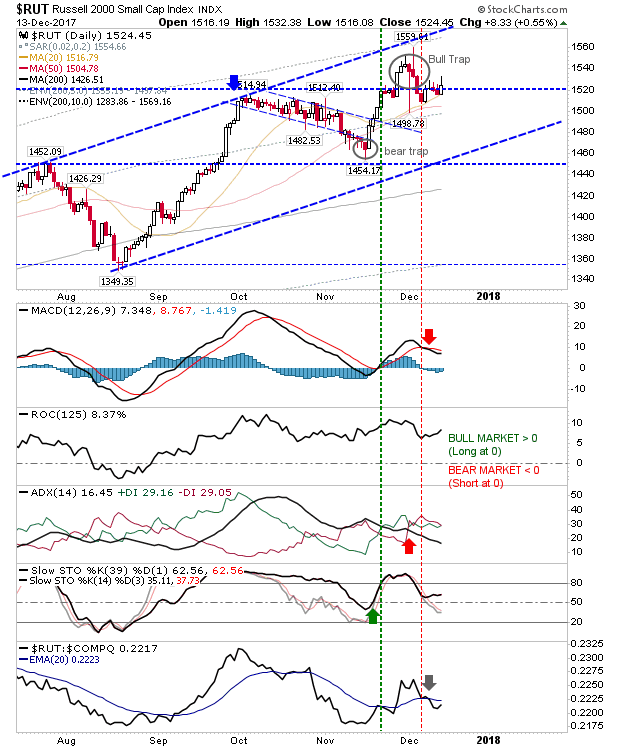

The Russell 2000 had the best of today’s action and looks to be attracting buyers at the expense of other indices. Of the lead indices, it looks best positioned to rally as it continues to challenge its ‘Bull Trap’.

Semiconductors remain the one index which didn’t enjoy the recent run of buying but the failure to undercut 1,211 also gives bulls something to work with. If there is a rally over the next few days it may be enough to start a challenge of 1,342; stops on a loss of 1,231.

For tomorrow, sellers have the S&P and Nasdaq to work with. Buyers have the Russell 2000 and maybe the Semiconductor Index to work with.

Leave A Comment