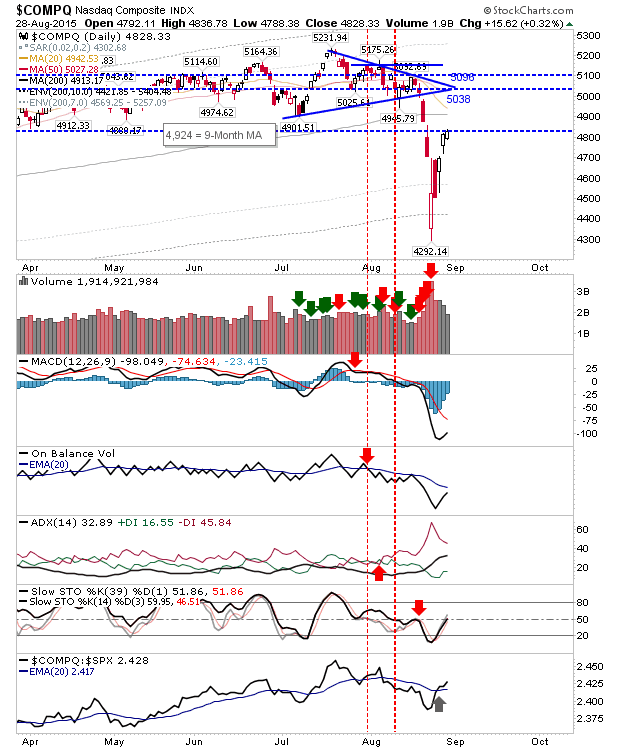

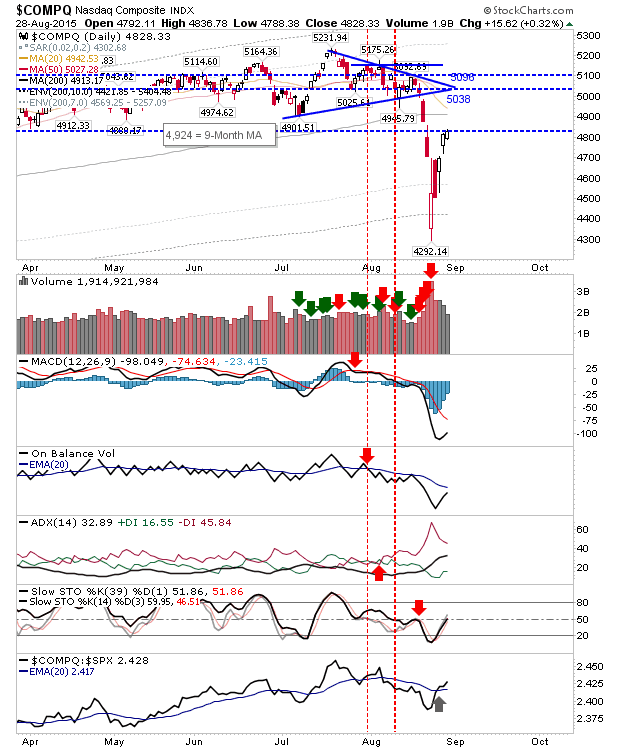

After all the volatility during the week, Friday’s action was a little reprieve. Markets sit at a point where shorts will fancy their chances, although further upside should not be viewed as surprising given the level of volatility markets experienced last week. If there is an indication bears are going to come back with a vengeance, it’s that buying volume has been well down on prior selling.

The Nasdaq finished on former trading range support, turned resistance. Watch for a short squeeze from this level, up to the 200-day MA.

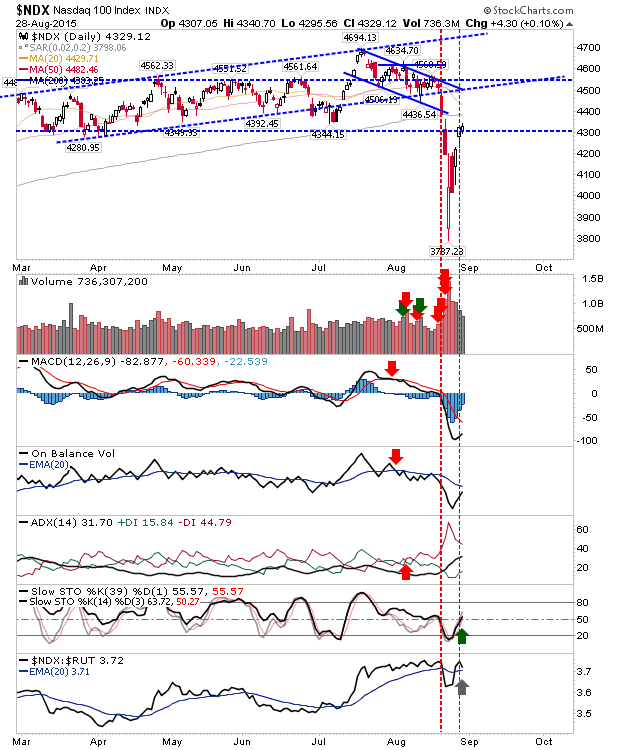

The Nasdaq 100 may have given an indication of what to expect on Monday as it started to edge more into the prior trading range. It’s about 50 points away from its 200-day MA.

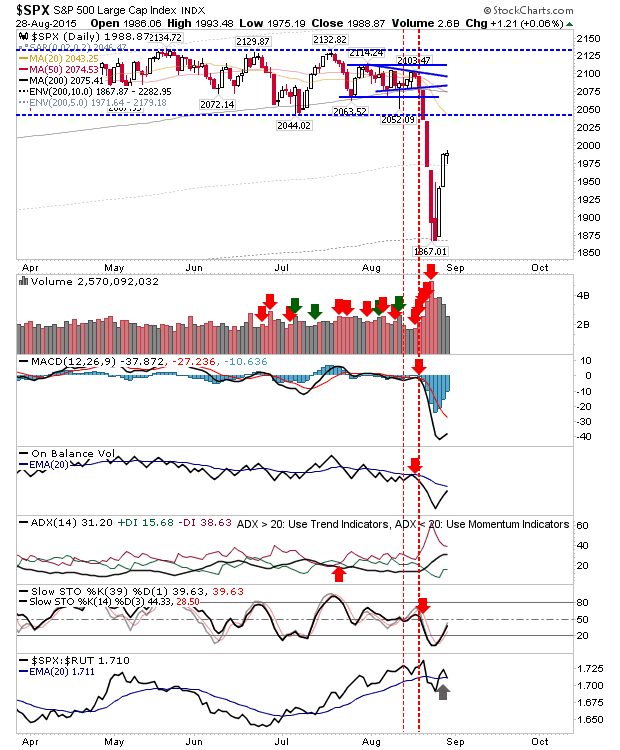

The S&P is caught in the middle of nowhere, neither close to support or resistance. Traders may look to trade a break of Friday’s tight intraday range.

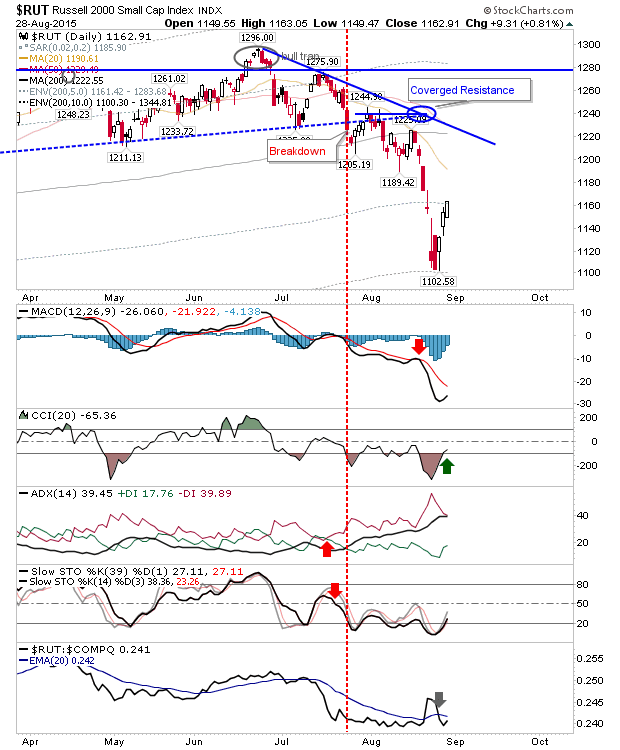

Small Caps had the best of Friday’s action. The 20-day MA is the nearest resistance level with the CCI on a fresh ‘buy’ signal.

Monday will be for watching how the intraday range established on Friday breaks. Tech indices are the most likely to reward shorts.

Leave A Comment