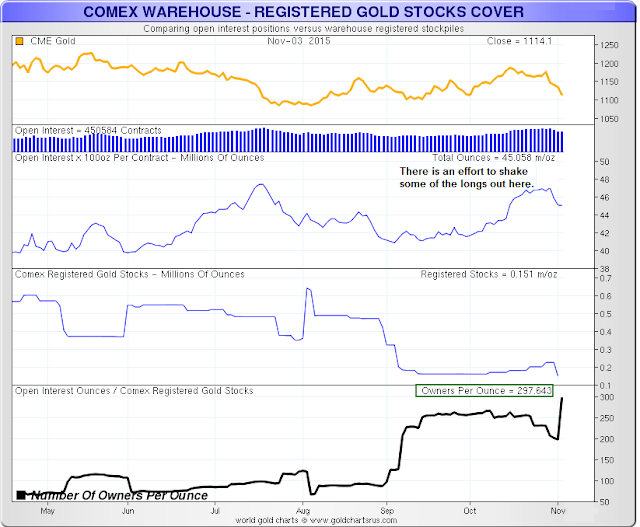

The number of potential claims (open interest) to the total amount of gold registered as ‘deliverable’ into those claims has reached a new high ratio of about 298 to 1.

It appears that JPM has accumulated physical bullion which, if history repeats, it may be prepared to deliver into demand for gold bullion the active month of December if required. Some of that gold is being held in the Nova Scotia warehouse in addition to their own.

There are those who will say that this means nothing. And yet, we have never seen such high ratios of potential claims to gold marked for delivery before.

A ‘New Gold Rush’

Why is this happening now? It is because those who are holding their gold in the Comex warehouses do not wish to see a physical short squeeze, that may begin in an overseas market, sweeping away their own bullion at these prices.

If a run on the available ‘float’ of bullion begins in earnest, the unwinding of these high levels of claims per ounce and hypothecation of ownership, especially in unallocated accounts, could provide some serious fireworks.

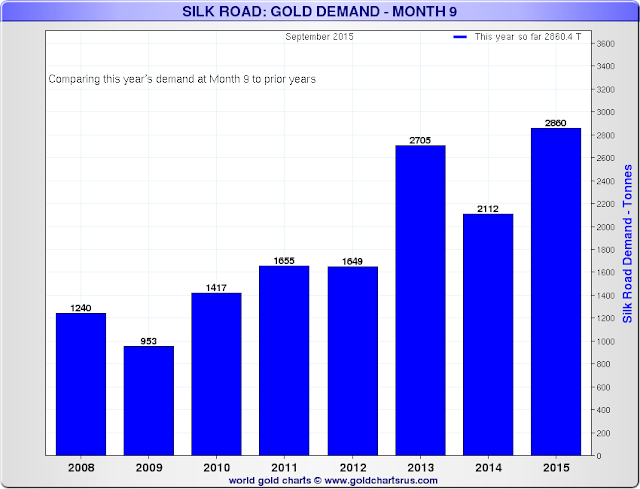

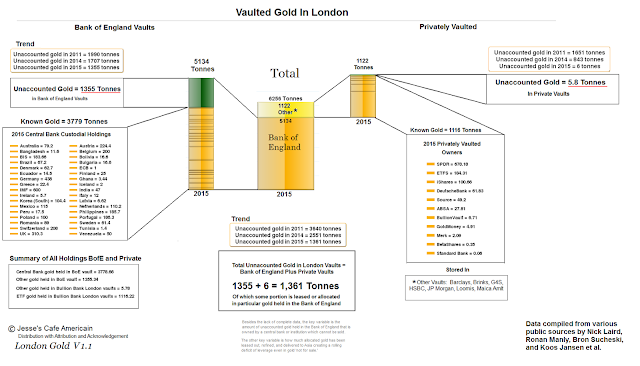

A determined campaign to control the price of gold, that has been underway since early 2013 by the new London Gold Pool, is bumping up against shortages in available gold in New York, London, and Switzerland caused by the truly impressive demand for physical bullion in the ‘Silk Road’ countries of China, India, Russia, and Turkey.

These sorts of things will always end in collapse, as one or two key players withdraw their support and begin to shepherd their national holdings, repatriating them to their home countries in order to control the integrity of their ownership in an increasingly hypothecated market.

These charts are from Nick Laird at goldchartsrus.com.

Leave A Comment