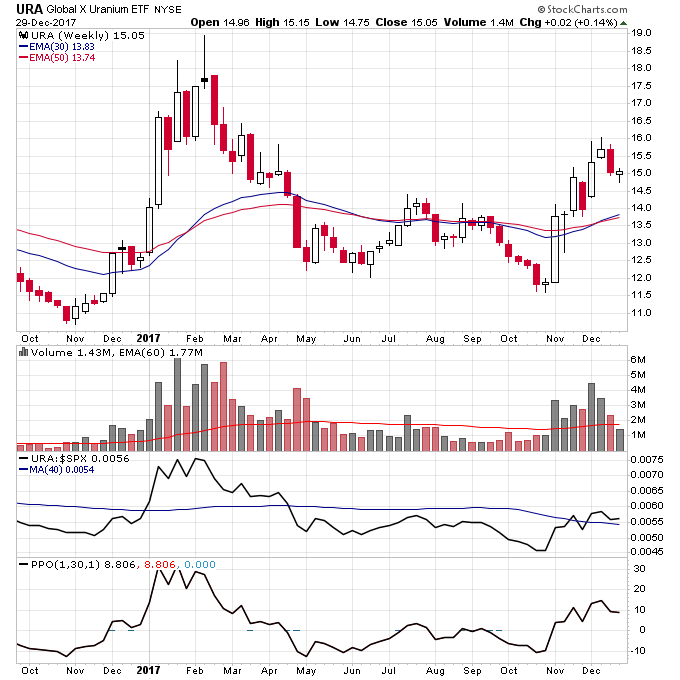

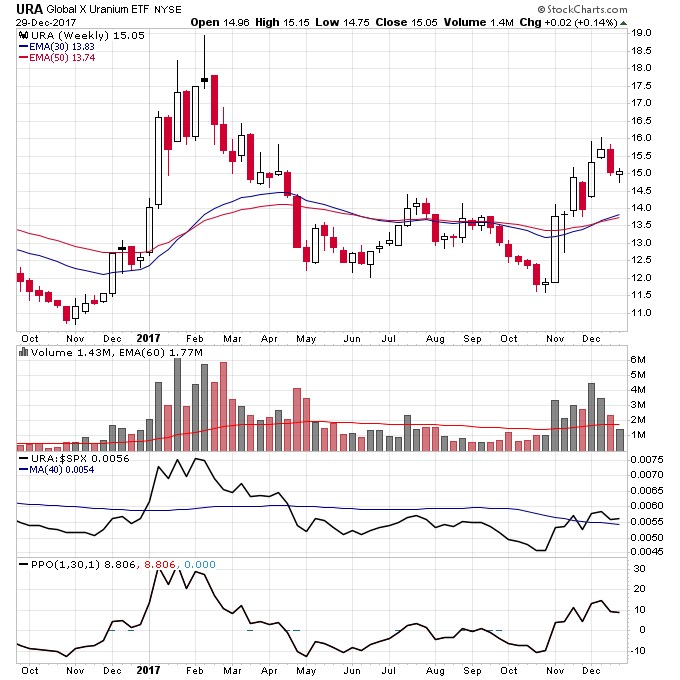

I ended 2016 and started 2017 with a big focus on uranium stocks. This was because they were ripping out of a Stage 1 base on huge volume towards the end of 2016.Uranium stocks had been destroyed for the last 5 years so this had the potential to be a monster trade.

The stocks did well for a few months and by taking some partial profits I made money on some of my uranium positions. But I also held onto a few uranium miners too long as the rally started to fizzle out in March and gave back some profits. I ended up moving on to other sectors as the uranium miners eventually broke down and went back into a Stage 1 base until the end of the year.

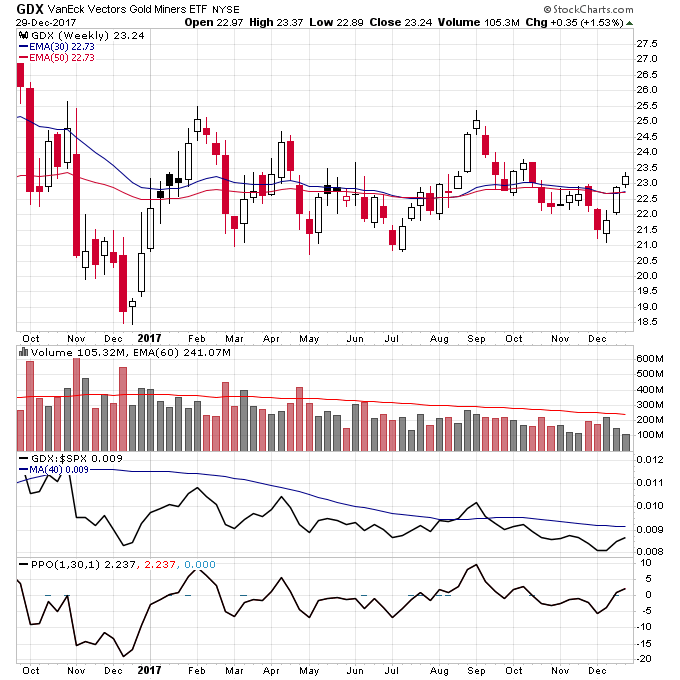

I made huge profits in gold miners in 2016 which enabled it to be my best year performance-wise since I’ve been trading. But fortunately using my Stage Analysis system I avoided gold miners for the most part in 2017 as they were simply drifting sideways in a consolidation the entire year. Even when many were turning bullish on gold in September I looked at the charts of many gold and silver miners and saw no volume increase that almost always accompanies a new rally. You can see that in the chart below of GDX where even though it started rallying back then volume was still well below average. By avoiding gold miners I was able to trade other sectors that were in strong uptrends in 2017.

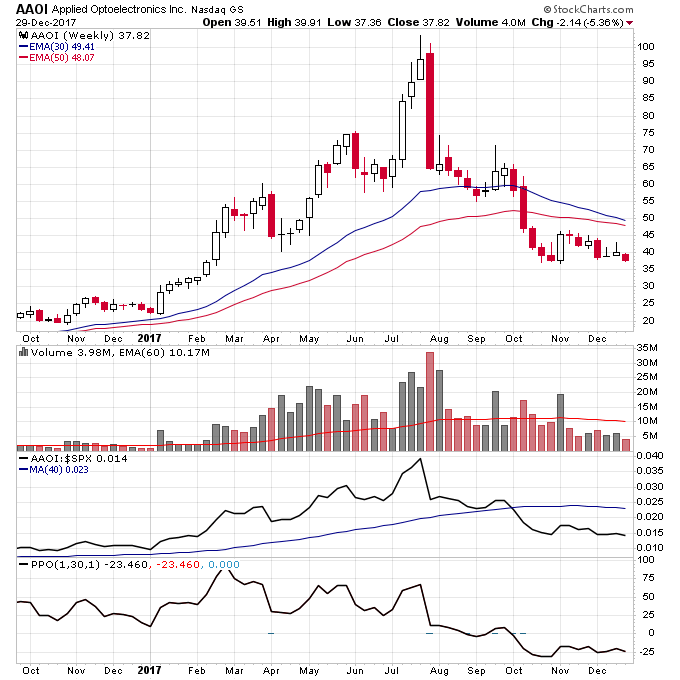

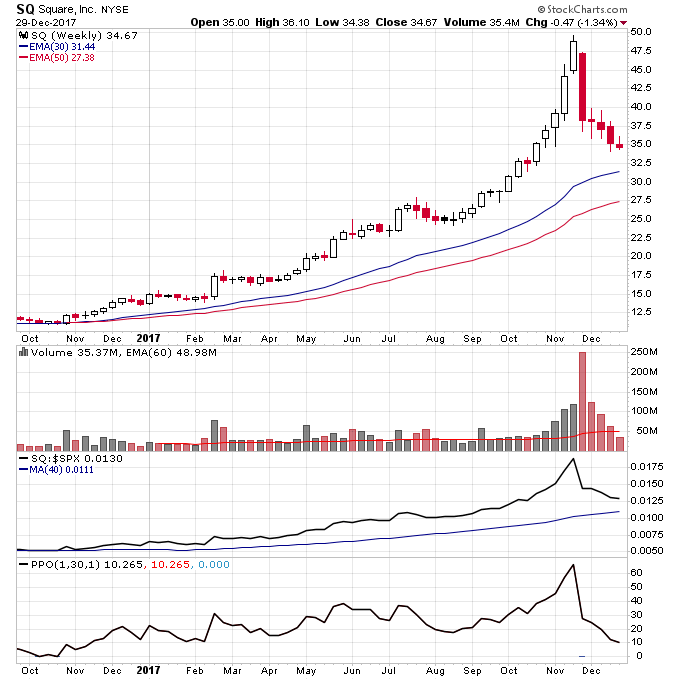

One of the other mistakes I made early in 2017 was being a little too focused on uranium.This made me miss some awesome Stage 2 breakouts early in the year in stocks like AAOI and SQ (shown below). If I would have diversified and taken trades in those stocks when they broke out, I could have added to those positions at the same time I cut back my uranium positions. This was a good lesson to learn in that if you see multiple sectors breaking out then there’s no reason not to take trades in each of them, since it’s impossible to know which rally will be stronger.

I applied this lesson for the rest of 2017 and it worked well for the last 4 months of the year since there were so many sectors breaking out such as tech stocks, bitcoin-related stocks, cannabis stocks, and some commodities producing stocks towards the end of the year.

Leave A Comment