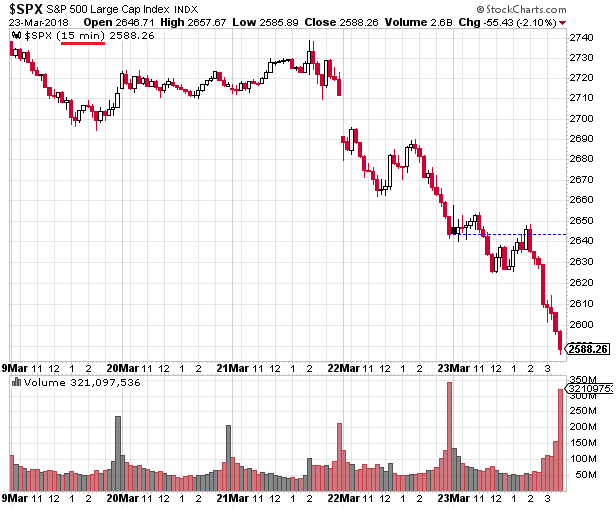

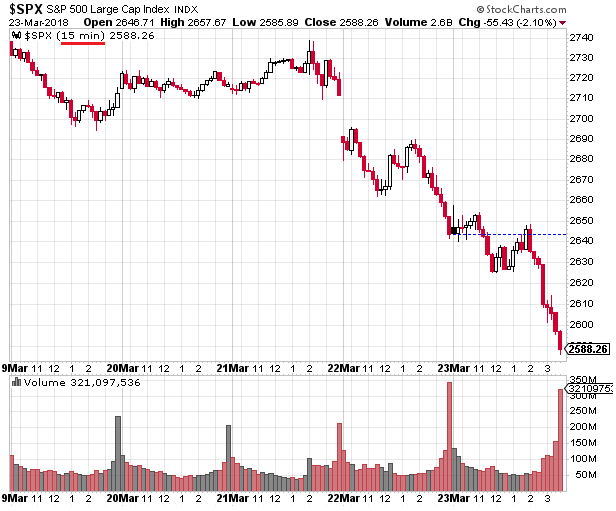

This past week was certainly a difficult one for the market and by default, a difficult one for investors. Most of the weakness occurred on the last two days of the week, which resulted in the week’s return for the S&P 500 Index ending at a negative 5.98%.

Even with the recent market weakness, on a total return basis, the S&P 500 Index is up over 18% since the beginning of 2017 and down just 2.76% year to date through Friday’s close.

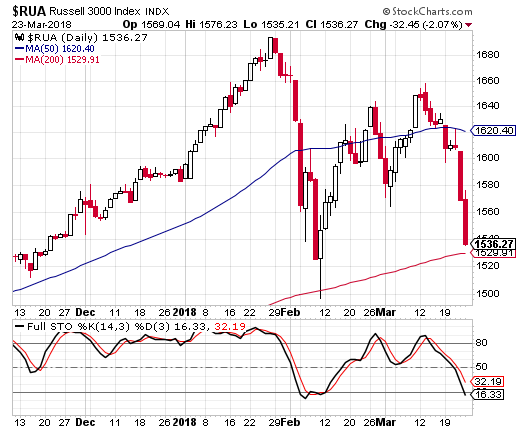

Many of the indices are nearing important technical support levels. As can be seen in a number of the various index charts below, the closing price for each respective index falls just above its 200 day moving average. The market weakness that began in late January, and for the S&P 500 Index specifically, initially culminated in a closing low of 2,581 on February 8. After this past week, a retest of the February 8 low seems to be playing out with the market’s close on Friday at 2,588.

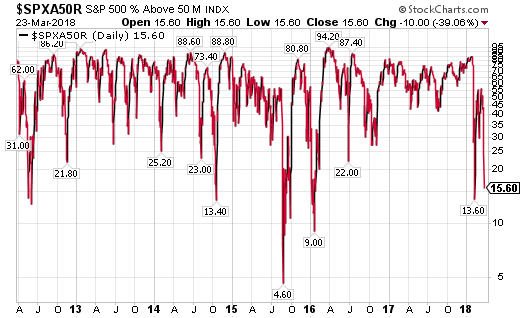

On a short term basis the indices appear to be oversold. One measure to evaluate is the percentage of stocks trading above their 50 and 200 day moving averages. The first chart shows only 15% of S&P 500 stocks are trading above their 50 day moving average. The chart shows that this measure can get reach the single digits, but mid to low teens is one indication of a short term oversold market.

Conversely, the percentage of stocks trading above their 200 day moving average is 51%. This percentage falls in the lower end of a long term range, with some oversold levels reaching into the mid to upper teens though. In other words, short term, the market appears oversold, but on a longer term basis, not so much.

And lastly, on a sentiment basis, the equity only put/call ratio is elevated at .76, but not at a contrarian oversold level of 1.0 or higher. For readers, the equity put/call ratio measures the sentiment of the individual investor by dividing put volume by call volume. At the extremes, this particular measure is a contrarian one; hence, P/C ratios above 1.0 signal overly bearish sentiment from the individual investor.

Leave A Comment