The irrational market got you seeing double again? Virtu’s algos just slammed all your bid and ask-side stops? All your shorts soaring and your longs tumbling while the market’s multiple continues to grow solely thanks to the Yen carry trade?

For some this centrally-planned trading environment is a nightmare which leads to trading paralysis, like for example Dennis Gartman:

Do we believe this rally? No, we do not. We refuse to believe that “terror” is bullish. We refuse to believe that the deaths of 129 innocent people by madmen are materially supportive of stock prices. We refuse to accept the notion that the odds of a Fed tightening are reduced modestly and that that is massively supportive of stock valuations. We refuse to believe that common sense has been cast overboard entirely… We are indeed in a brave new world. It is a world we are not particularly fond of, however, if this is the new reality…. We refuse to believe that common sense has been cast overboard entirely, and so neutral we are and neutral we shall be.

Others however, are far more pragmatic. Case in point, the smart money which according to Bank of America is taking advantage of this latest rebound in stocks to sell to who else: the traditionally biggest sucker in the room – retail investors. To wit:

Second week of institutions & HFs selling vs. retail buying

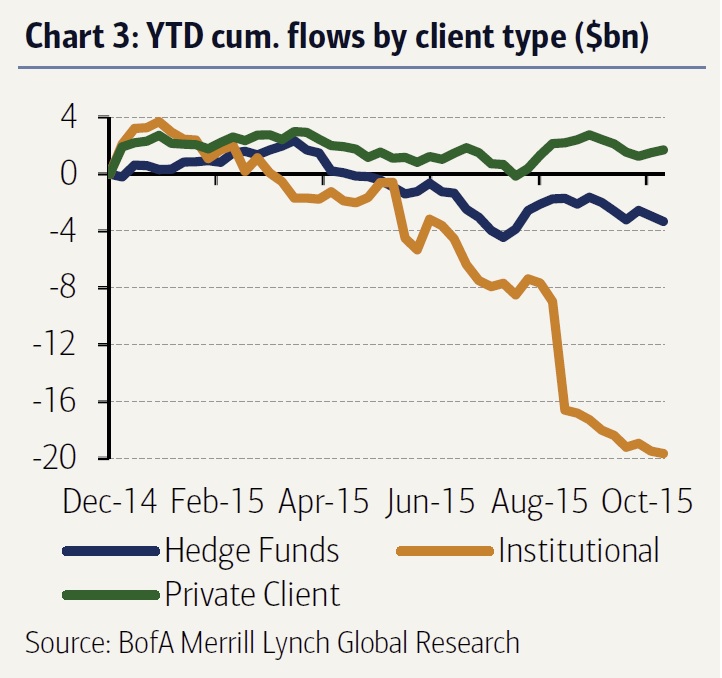

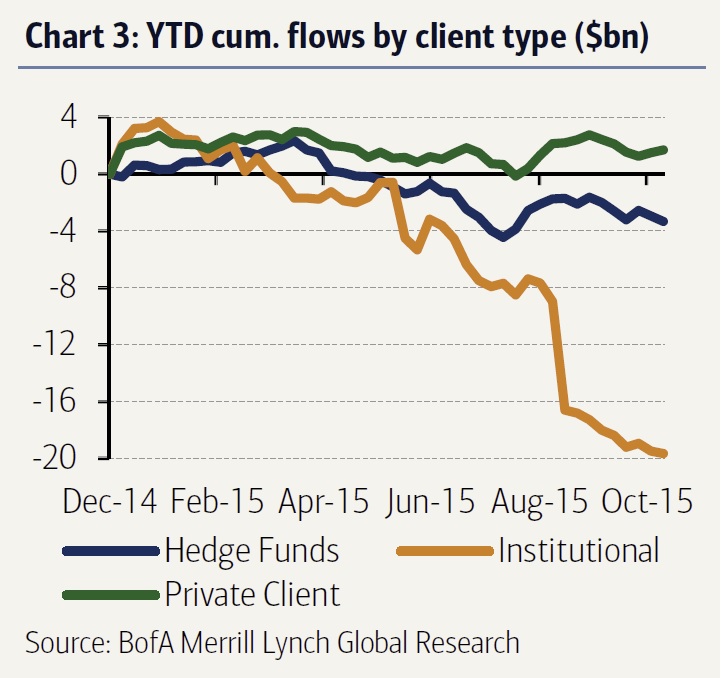

Last week, during which the S&P 500 fell 3.6%, BofAML clients were net sellers of US stocks for the second consecutive week, in the amount of $868mn. Hedge funds, followed by institutional clients, were the biggest net sellers – this was the second consecutive week of net sales for both groups.

Some more details:

Leave A Comment