Recent data about the Chinese auto market indicates a 7 year high drop in monthly auto sales, indicating much more than seasonal weakness in auto demand.

The three-month downturn in auto sales in China is a negative factor for global automakers as well as domestic producers due to their heavy investments in China on the expectation of a solidly growing market.

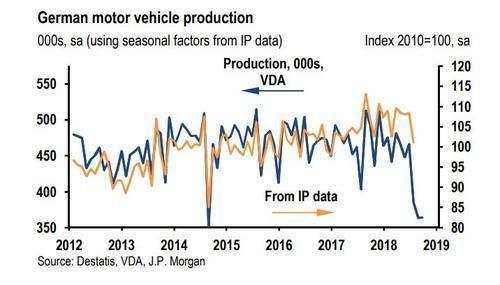

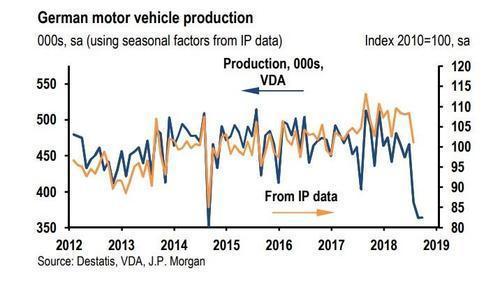

The German auto manufacturers are faring no better, seeing almost a 30 percent drop in the motor vehicle production index since the second half of 2017.

Source: Zerohedge

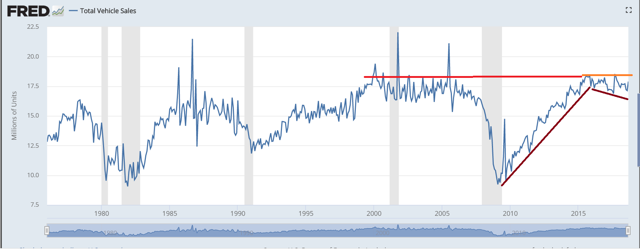

Looking at US data from the Fed, we can see that auto sales have appeared to reach a late cycle peak from 2015 and likely won’t recover until consumers address their personal balance sheets. Years of cheap credit and generous dealer incentives are having decreasing effect in driving new sales.

Source: Federal Reserve

With auto markets around the world reaching peaks, it appears the consumers needs to deleverage before auto sales can recover. This deleveraging likely means we are heading into the next recession.

The depth of this recession will depend on how much debt consumers need to pay back, as well as how well companies are positioned to weather the downturn. Given sky high debt ratios for many US companies, it does not appear the next recession will be over very quickly.

In this video, I discuss how long the recession could last, how it could affect the auto manufacturers, and how consumers can prepare by acting early to fix their personal balance sheets to minimize the pain of the changing business cycle.

Leave A Comment