There’s a 60 percent likelihood of a recession in the next four years, according to The Wall Street Journal’s survey of economists. The economists pegged the odds of a recession beginning in the next 12 months at about 20 percent, an estimate with which I concur. Let’s talk about why we’ll likely have a recession, and what businesses can do about it now. (See also the statistical note at the bottom of the article.)

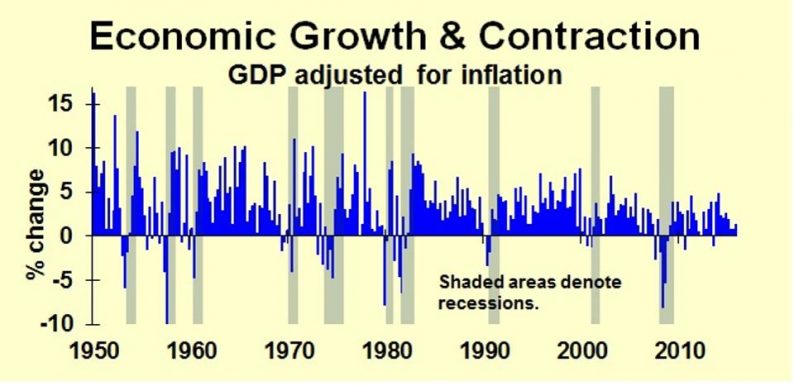

The current expansion is fairly old, as expansions go, over seven years of age compared to an historical average of just over three years. But the length of an expansion does not correlate with the probability of a recession, so age does not tell us anything.

The frequency of recessions averages one about every six years, but with wide variation—as short as 18 months from the beginning of one recession until the beginning of the next, and as long as 140 months. So an estimated probability of recession in the range of 10 to 20 percent puts us in normal territory.

Right now the most likely trigger of a recession seems to be foreign economic difficulties, which could be a European financial crisis, or European recession triggered by Brexit, or a significant downturn in China and the rest of east Asia. The most likely domestic triggers include political change and premature tightening by the Federal Reserve.

More importantly, what should a business do about the risk of recession? Earlier this year I wrote a book about business management under uncertainty. The best tip for business managers considering the possibility of recession is contingency planning. The assignment I recommend to audience members in my speeches is go to the bar or coffee shop of your choice with a single sheet of paper. Identify your company’s greatest risk. It could be recession, as we’re discussing now, or it might be new competition, new technology, a change of social attitudes or a government regulation. Whatever the risk, sketch out what you would do if it came to pass.

Leave A Comment