Photo Credit: eflon || Ask to visit the Medieval dining hall! Really!

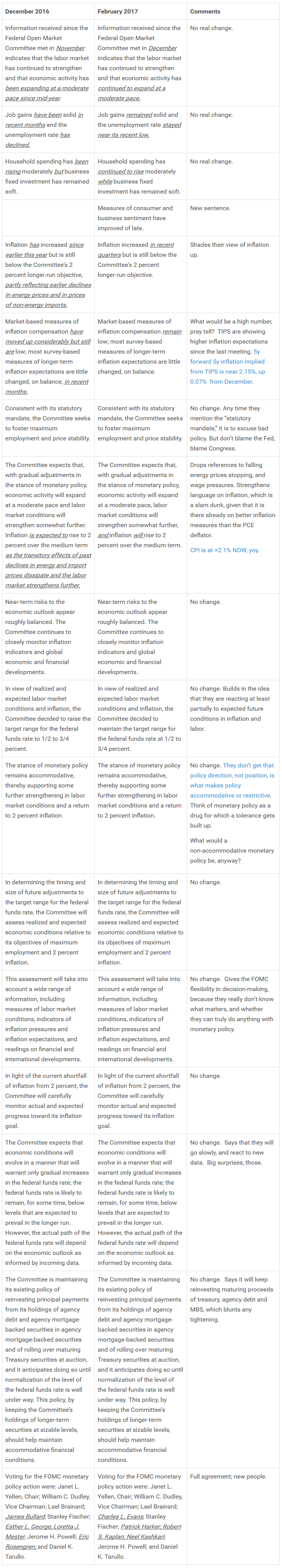

Comments

The global economy is growing, inflation is rising globally, the dollar is rising, and the 30-year Treasury has not moved all that much relative to all of that. My guess is that the FOMC could get the Fed funds rate up to 2% if they want to invert the yield curve. A rising dollar will slow the economy and inflation somewhat.

Aside from that, I am looking for what might blow up. Maybe some country borrowing too much in dollars? Tightening cycles almost always end with a bang.

Leave A Comment