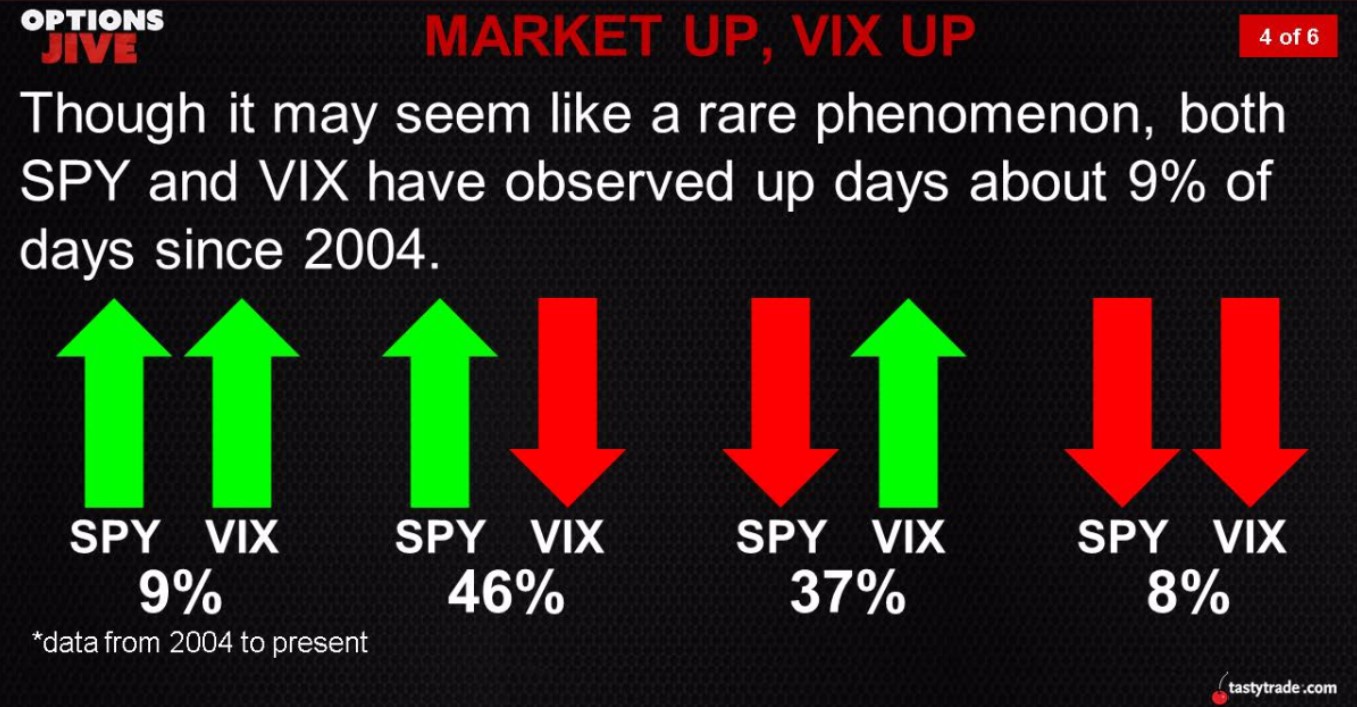

Monday’s trading was yet another example of a day where the market went up and the VIX went up. There seems to be quite a few of these occurrences happening as the market hasn’t fallen much, but the VIX occasionally catches a bid because of various potential worries such as geopolitical or monetary policy concerns. The slide below shows that the S&P 500 and the VIX have risen simultaneously about 9% of the time. Today the VIX was up 9.17% and the S&P 500 was up 0.07%.

As someone who is open to the bearish thesis, you’d think I’d make the point that this is a sign of further volatility to come. However, I don’t feel the need to add hyperbole to a market with many real bearish factors in play. As you can see from the chart below, an increasing VIX doesn’t predict a falling stock market. It does have the lowest 45-day return, but it’s still positive like it is for the other three scenarios.

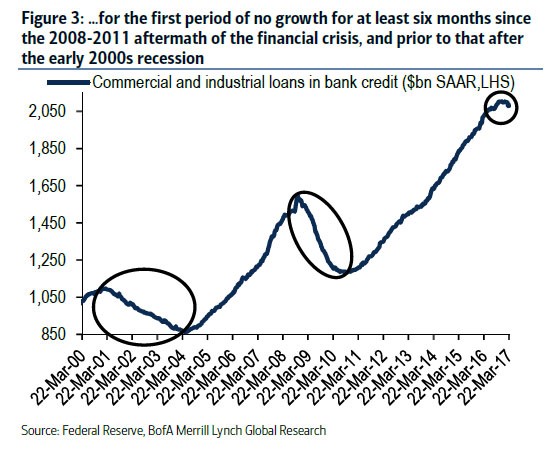

As I was mentioning in my previous article, there isn’t much evidence to support Morgan Stanley’s claim that the cycle has twelve months of gains left. As you can see in the chart below, C&I lending is starting to deteriorate like it did in 2008 and 2001. If the stock market is supposed to perform like it did in 1999 and 2007, shouldn’t the C&I lending growth be on its last gasp higher instead of starting to fall? With that being said, I don’t expect the C&I lending to take a sharp downturn lower until we see some weakness in the labor market outside of one month which was influenced by a winter storm. There aren’t any indicators which are falling sharply which would signal the recession has started. There are simply warning signs like the one below combined with the old age of the business cycle which signal a clear yellow caution flag.

As you can see from chart below, consumer bank credit is starting to decelerate as the growth rate is below half last year’s rate. The consumer data is like most aspects of the economy; it is showing mixed results. The sentiment indicator is high, but it looks like the Q1 GDP report will show below 1% retail sales growth. It’s possible that mixed results could signal we’re near a recession. However, this entire recovery has been one of fits and starts meaning the economy may only be in a mini-soft patch. Usually a recovery has a mid-cycle slowdowns. This recovery has had multiple slowdowns because it has been long and weak.

Leave A Comment