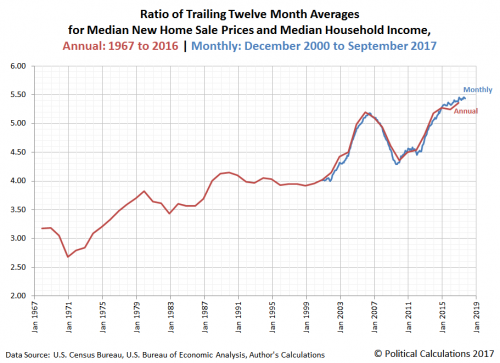

Over the weekend, when looking at the record high ratio in median new home sale prices to household incomes in the US, we concluded that US homes have never been more unaffordable for the average American.

What about renting? Isn’t it intuitive that if buying a house has never been more expensive, then at least renting should be cheap(er).

Unfortunately no, because not only is renting not cheap(er) in either absolute or relative terms, but when observed through the prism of the only thing that matters, namely disposable income, renting – just like buying a house – has never been more unaffordable.

While it is no secret that rent inflation has been one of the few outliers that the Fed has gotten “right” in its ongoing reflationary attempt, with record rents and rising shelter costs accounting for most of rising CPI during the current centrally-planned business cycle…

… the question of whether these rising costs have left the average American behind has been largely ignored. Which is unfortunate, because with rental costs growing faster than disposable income for 22 consecutive months, what the chart below shows is that as of September, rent ate up more disposable income than at any prior time in history.

Which unfortunately means that while US housing has never been more unaffordable, renting in the US has… well, also never been more unaffordable. Meanwhile, the Fed remains perplexed by the “mysterious” lack of inflation and will keep inflating asset bubbles until it finally realizes that the simplest things in life have never been more out of reach of the average American (or, more likely, until the entire financial house of cards finally comes crashing down).

And so, congratulations dear middle class, or what’s left of it, and don’t forget to BTFD if you want a roof above your head.

Leave A Comment