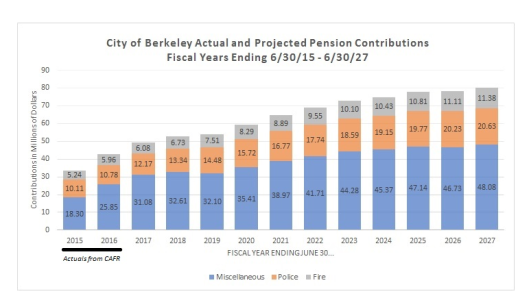

The California Policy Center estimates Required Pension Contributions Will Nearly Double in 5 Years. I claim it will be much worse.

In the fiscal year beginning in July, local payments to the California Public Employees’ Retirement System will total $5.3 billion and rise to $9.8 billion in fiscal 2023, according to the right-leaning group that examines public pensions.

The increase reflects Calpers’ decision in December to roll back the expected rate of return on its investments. That means the system’s 3,000 cities, counties, school districts and other public agencies will have to put more taxpayer money into the fund because they can’t count as heavily on anticipated investment income to cover future benefit checks.

Including the costs paid by cities and counties that run their own systems, the fiscal 2018 tab will be at least $13 billion to meet retirement obligations for public workers, according to the analysis, which is based on actuarial reports and audited financial statements.

Barring any changes to pensions, “several California cities and counties will find themselves forced to slash other spending,” the group wrote in its report. “The less fortunate will simply be unable to pay the bills they receive from Calpers or their local retirement system.”

Quadruple is More Likely

The California Policy Center Report details 20 cities and counties reporting pension contribution-to-revenue ratios exceeding 10%. San Rafael, San Jose, and Santa Barbara County head the list at 18.29%, 13.49%, and 13.06% respectively.

The report “reflects the impact of CalPERS’ recent decision to change the rate at which it discounts future liabilities from 7.5% to 7%“.

Lovely.

A plan assumption of 7.0% is not going to happen. Returns are more likely to be negative than to hit 7% a year for the next five years.

As in 2000 and again in 2007, investors believe the stock market is flashing an all clear signal. It isn’t.

Leave A Comment