My Swing Trading Approach

Some resistance lingering overhead that I note below, and providing issues for the overall stock market. I will consider adding another position to the portfolio today, but won’t allow myself to stretch too far out. I will look to protect profits on existing positions as my #1 priority.

Indicators

Industrials was the market’s big winner yesterday and pushing through some heavy resistance. It was followed by Energy and Technology. Utilities breaking down in a big way yesterday, with investors fleeing the sector.

My Market Sentiment

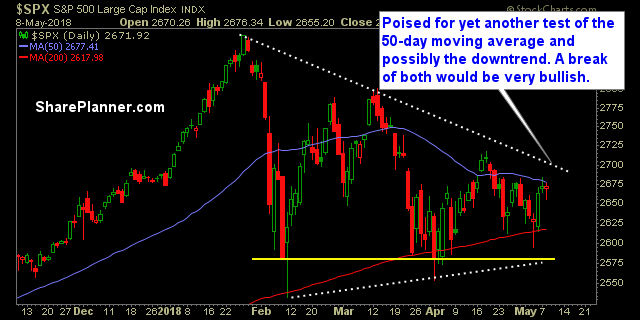

With Trump pulling out of the Iran deal, the market rallied with oil off of the lows, but still finished lower, overall. The downtrend off of the January highs should pose some resistance today on the market rally, and of course the 50-day moving average as well.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment