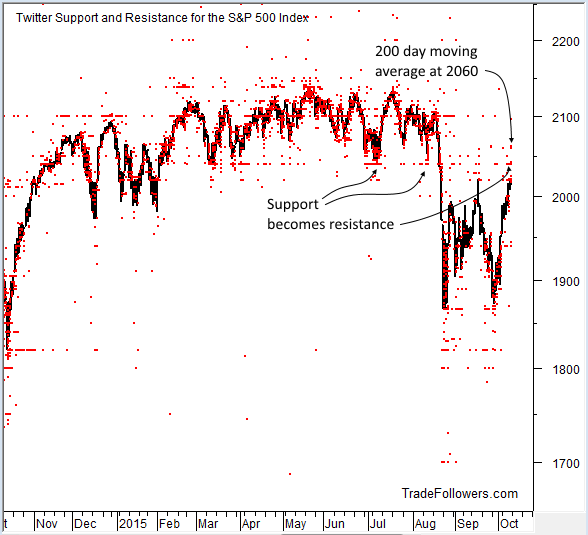

My read of the Twitter stream sees some resistance ahead for the S&P 500 Index (SPX). The most obvious sign comes from support and resistance levels gleaned from Twitter. Most tweets above current prices are at 2040 on SPX, which is the last major support level to break. It has now become resistance. The next most tweeted level is near 2060 where the 200 day moving average for SPX comes into play. It appears that traders on Twitter are not looking up with hope, rather they’re looking for a place to take profit or initiate shorts.

Another source of resistance comes from sector sentiment. In the past when all sectors have had positive readings it indicated exhaustion and marked a short term top. The last instance was on May 22nd, just a few days after the all time high in SPX. At the least we should expect some chop before going significantly higher.

Quantified tweets for SPX are showing a mixed picture. On the positive side, 7 day sentiment has finally broken its downtrend line. This is the first hurdle the market must make to right sentiment. Unfortunately almost everything else shows some resistance. Daily momentum is still having trouble making prints above zero which is causing 7 day momentum to turn back down from the zero line. The last time this happened was just before the market broke down hard in mid August.

One thing of note on 7 day momentum and sentiment is that during the duration of the long term bull market overbought reading came in the +15 to +20 range while oversold readings were contained at -5 or -6. The last three dips in 7 day momentum were -11, -16, and -23. If the market is changing from long term bullish to long term bearish I expect to see overbought readings contained in the +5 to +10 range and oversold readings to shift to -15 to -20. It’s too early to make a call, but this is something to watch carefully going forward. You can see the daily chart of Twitter sentiment here. What the bulls really want to see is a dip in price for SPX that doesn’t do much damage to sentiment. This would indicate that market participants are buying the dip. A fall in 7 day momentum to -15 on the next dip would give strong evidence that the market has turned from bullish to bearish in the long term.

Leave A Comment