The big retail chains are generally seen as pretty good barometers of the health of “the consumer.” And since — in today’s late-cycle debt-binge pseudo-capitalism — the consumer drives the economy, the numbers coming out of the aforementioned retail chains should be cause for worry.

First Macy’s (M) got our attention:

Macy’s Sounds a Holiday Alarm, and Retailers Brace for Heavy Discounting

(New York Times) – When Macy’s, a store closely associated with Christmas, says there is trouble brewing ahead of the holidays, it is enough to send the world of shopping into a tailspin.

The retailer of “Miracle on 34th Street” warned Wednesday that its stores were awash with merchandise after a sluggish fall season and that slow business would force it to go all-out on discounts during the holidays.

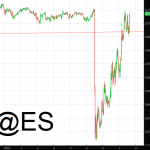

Macy’s shares plunged about 14 percent, dragging other retailers down, too. The Hudson’s Bay Company, which owns Saks Fifth Avenue and Lord & Taylor, fell 5 percent, as did Kohl’s. Burlington Stores fell about 7 percent.

Then Nordstrom (JWN) dropped a bomb:

Nordstrom Shares Plunge After Profit Misses Analysts’ Estimates

(Bloomberg) – Nordstrom Inc. fell as much as 18 percent in late trading after missing third-quarter earnings estimates and cutting its annual forecast, renewing concerns about a slump in the department-store industry.

Profit amounted to 42 cents in the period ended Oct. 31, Nordstrom said in a statement Thursday. Excluding some items, the earnings came to 57 cents. Analysts had projected 72 cents on average, according to data compiled by Bloomberg.

Nordstrom follows Macy’s Inc. in reporting disappointing results, underscoring a broader slowdown for department stores. Consumers are spending less of their money on apparel and accessories, shifting their budgets to cars, homes and technology. Retailers and clothing suppliers also have struggled to pare down excess inventories, forcing them to rely more on discounts.

The results reflected “softer sales trends that were generally consistent across channels and merchandise categories,” the Seattle-based company said in the statement.

The shares tumbled as much as $11.68 to $51.79 in late trading in New York. Nordstrom already had slid 20 percent this year through the close of regular trading Thursday.

Nordstrom’s same-store sales, a closely watched benchmark, grew just 0.9 percent last quarter. Analysts had estimated 3.6 percent, according to Consensus Metrix. The Rack outlet business, a former bright spot for the business, also suffered in the period. Same-store sales fell 2.2 percent, missing a projection for growth of 2.8 percent.

Leave A Comment