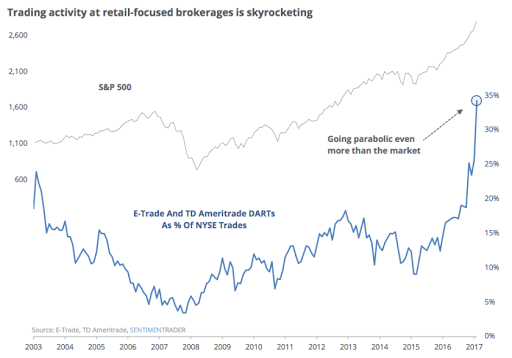

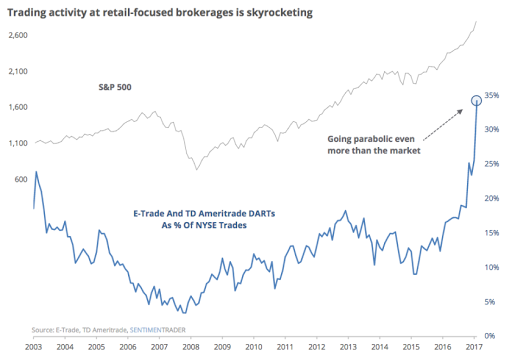

We showed previously that as the broader market was melting up in a blow off top move, retail investors just couldn’t get enough: this is shown best in the following brokerage DART chart from Sentiment Trader.

This morning E-Trade confirmed that in January, with the stock market entering its parabolic-est move – just before the volocaust crushed countless retail vol-sellers, retail investors just couldn’t get enough, and the retail brokerage added a whopping 64,581 gross new brokerage accounts in Jan. closing the month with 3.7 million brokerage accounts, a net increase of 37,102 from December, 154% higher Y/Y.

The company also reported that net new brokerage assets were $1.5 billion in the month. During the month, customer security holdings increased by $17.4 billion, while brokerage-related cash barely moved, rising by just $0.1 billion to $53.0 billion. Customer margin balances increased $0.3 billion, ending the month at $9.4 billion.

The brokerage also reported that customers were net buyers of approximately $1.5 billion in securities during the month.

Meanwhile, the DART chart continue to rise, and January Daily Average Revenue Trades or DARTs increased 29% from December to 315,572 and a whopping 57% Y/Y.

Much more interesting, however, will be the February data – did last week’s correction spook retail investors, or did they simply double down, expecting a central bank bailout in a worst case scenario.

The full breakdown below.

Leave A Comment