It shouldn’t be too surprising that the XIV exchange-traded note – which is designed to deliver the inverse performance of the well-known CBOE Volatility Index (or the VIX) on a daily basis – is attracting fresh attention after surging as much as 87 percent this year.

But, as CNBC notes, some caution that investing in the exchange-traded product now could be deeply risky.

This could be “the most dangerous trade in the world,” according to macro strategist Boris Schlossberg of BK Asset Management.

“It’s already had a massive runup because we’ve had very low volatility,” but at this point, “it’s very likely that volatility is going to increase,” Schlossberg said Thursday on CNBC’s “Trading Nation.”

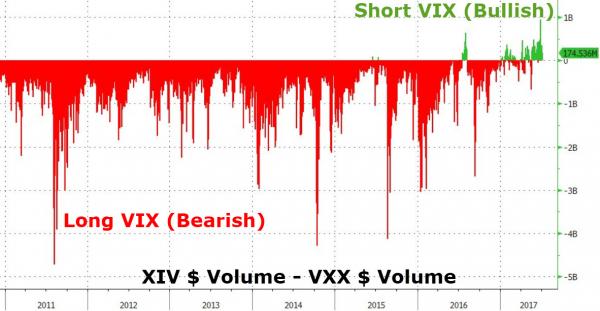

The rise in this product hasn’t escaped traders’ attention. In terms of the dollar value of shares traded, the short-VIX-futures XIV has actually surpassed the long-VIX-futures VXX.

“We think it’s especially interesting that there is now more XIV trading than VXX, perhaps pointing to the growing interest in shorting volatility among retail [investors] and others who are not specialists in volatility trading,” Pravit Chintawongvanich, head of derivatives strategy at Macro Risk Advisors, wrote in a Wednesday note to clients.

As for Schlossberg, his warning about the product is based on his view that volatility is set to rise from its current, ultralow levels.

“It’s simply a dangerous trade from a macro point of view,” he said Thursday. “As central banks begin to increase rates, we’re going to see more volatility, and this [product] is going to show some very negative days.”

In fact, “negative” may be putting it mildly. On a day when the VIX and the VIX futures double in value (perhaps due to bad news out of Freedonia), the VXX could easily double as well, while the XIV could perform the inverse move.

Leave A Comment