Retail sales were down according to US Census headline data. Our analysis shows the opposite.

Analyst Opinion of Retail Sales

Things to consider when viewing this data:

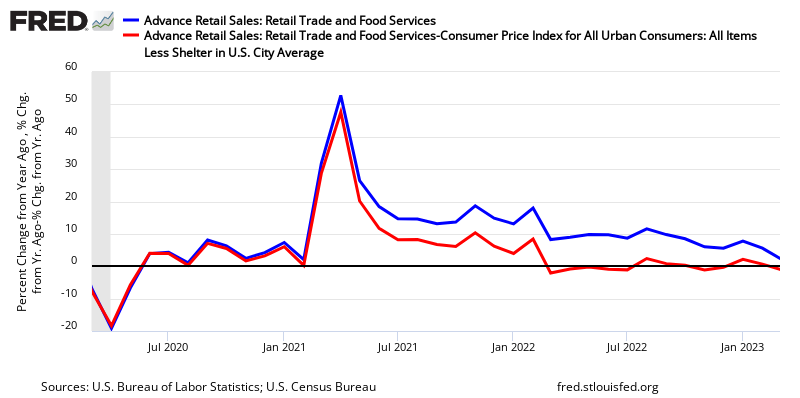

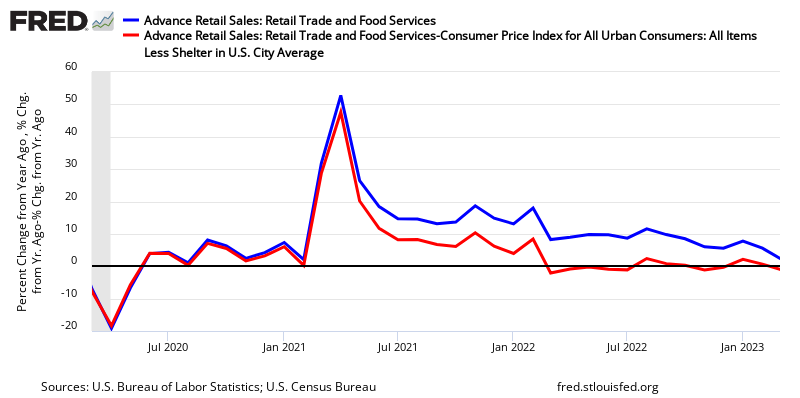

it is not inflation adjusted – and inflation in this sector is now running a little over 1.5 %.

the three month rolling averages of the unadjusted data improved.

our analysis says this month was an improvement over last month.

The relationship between year-over-year growth in inflation adjusted retail sales and retail employment are now correlating.

Backward data revisions were mixed.

Econintersect Analysis:

unadjusted sales rate of growth accelerated 1.8 % month-over-month, and up 5.2 % year-over-year.

unadjusted sales 3 month rolling year-over-year average growth accelerated 1.4 % month-over-month, 1.8 % year-over-year.

unadjusted sales (but inflation adjusted) up 1.3 % year-over-year

this is an advance report. Please see caveats below showing variations between the advance report and the “final”.

in the seasonally adjusted data – the major weakness was general mechandise stores. There was significant strength in non-store retailers, autos, and generally most items.

U.S. Census Headlines:

seasonally adjusted sales down 0.3 % month-over-month, up 3.8 % year-over-year.

the market was expecting (from Bloomberg / Econoday):

| seasonally adjusted |

Consensus Range |

Consensus |

Actual |

| Retail Sales – M/M change |

-0.2 % to 0.4 % |

+0.2 % |

-0.3% |

| Retail Sales less autos – M/M change |

-0.2 % to 0.5 % |

+0.2 % |

-0.3 % |

| Less Autos & Gas – M/M Change |

0.1 % to 0.5 % |

+0.3 % |

+0.0 % |

| Control Group – M/M change |

0.2 % to 0.4 % |

+0.3 % |

+0.0 % |

Year-over-Year Change – Unadjusted Retail Sales (blue line) and Inflation Adjusted Retail Sales (red line)

Leave A Comment