Variant Perception posted a couple of excellent charts on how rising rent and healthcare costs may impact consumer spending and related retail equities. Let’s tune in.

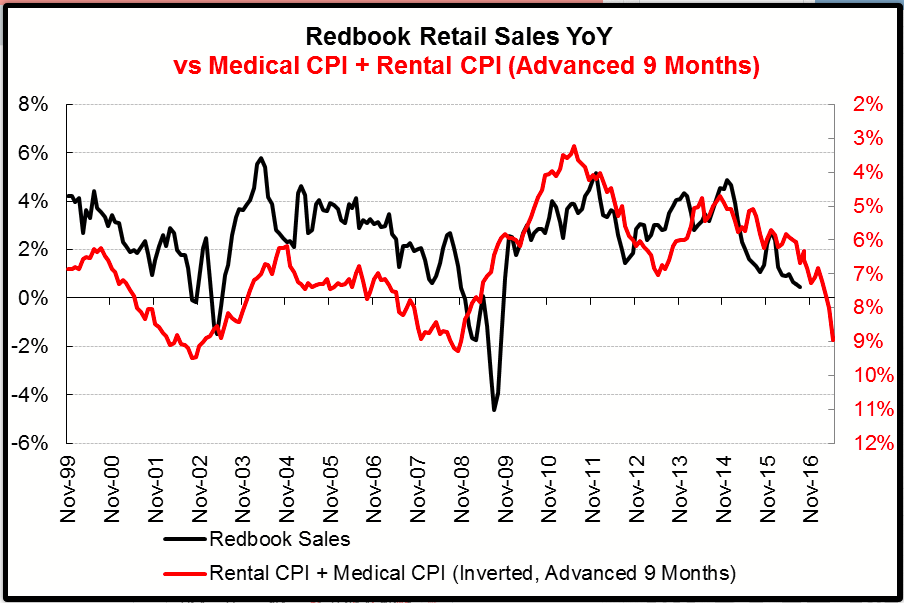

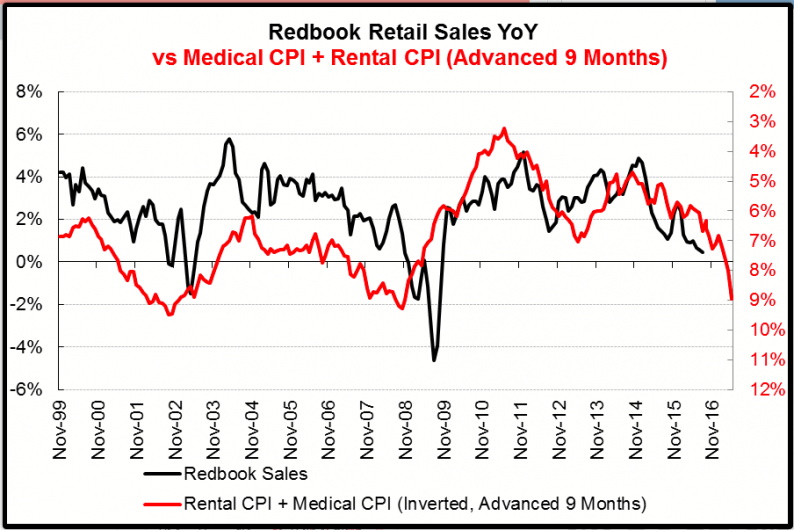

Retail Sales vs. Medical + Rental CPI Inverted

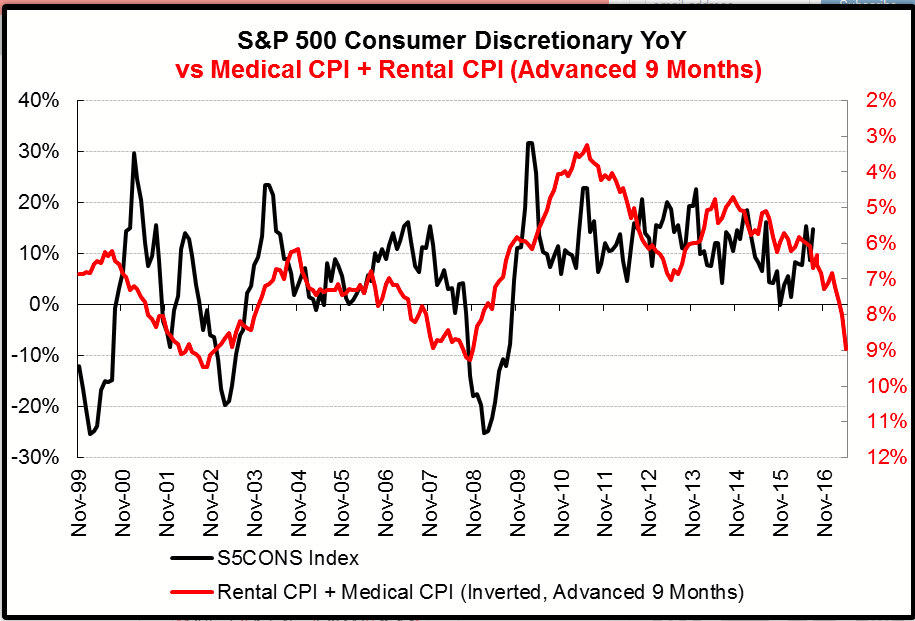

Consumer Discretionary Equities vs. Medical + Rental CPI Inverted

Key Points

Whenever rental and medical costs have risen significantly in the past, they have led to a big decline in retail sales. Consumers will start cutting back spending on non-essential items in order to pay for medical care and housing.

Retail stocks are highly correlated to the ups and downs of same-store retail sales. As you can see in the above chart, the S&P 500 Consumer Discretionary sector has fallen sharply when rental and medical costs have risen, notably in 2001-02 and 2008-09.

Leave A Comment