Yesterday’s US retail sales report for September inspired breathless headlines in some corners that consumer spending hit a wall. But a closer look at the numbers still leaves room for a healthy dose of optimism. At the very least, it’s premature to confidently warn that the revival in retail spending that began in 2016 has run its course.

True, the monthly comparison reflected weakness at the headline level. Spending increased by a thin 0.1% last month, well below the 0.6% gain that economists were expecting, based on Econoday.com’s consensus forecast. But stripping out the most volatile components to identify core retail spending that aligns with the consumer spending component of gross domestic product paints a brighter picture via a 0.5% jump in September.

The Wall Street Journal attributes the downshift in headline spending to temporary weather factors — last month’s Hurricane Florence, in particular, weighed on retail sales at stores and restaurants in the Carolinas, which were hit hard by the storm.

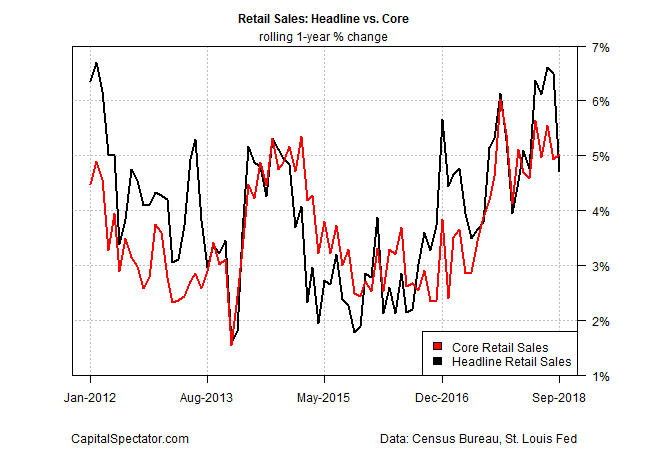

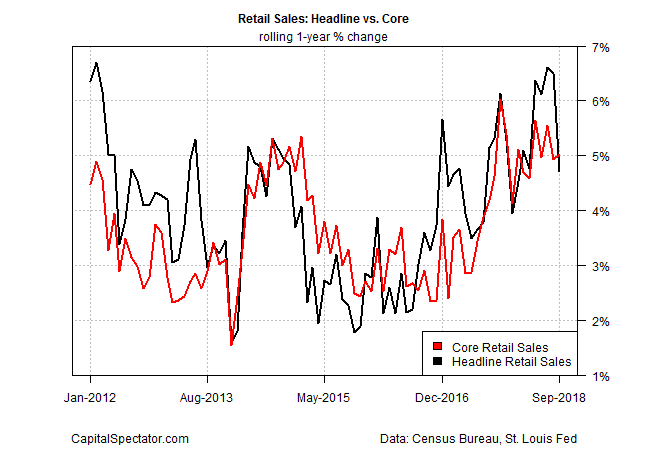

In any case, monthly comparisons are noisy generally and so it’s best to focus on the trend by way of rolling one-year changes for a superior estimate of the signal. By that standard, the September results remain encouraging.

Let’s start with headline retail sales, which decelerated to a 4.7% year-over-year gain last month, the softest pace since April. That’s still a healthy gain, but it looks weak after four straight months of 6%-plus annual increases. To be fair, the recent run of hot annual gains wasn’t sustainable and so a degree of downshifting isn’t surprising.

More importantly, core retail sales held steady last month at a 5.0% year-over-year increase for a second month. In other words, the rebound in consumer spending that’s unfolded following the 2015-2016 slowdown remains intact.

“The net result still appears to be a fairly strong quarter for consumer spending growth,” notes Jim O’Sullivan, chief U.S. economist at High Frequency Economics.

Leave A Comment