Going only from the conventional interpretation of the optimistic 242,000 in payroll gains Friday, it is still remarkable how more than one-fifth of those purported job creations in February were due to activity in retail trade alone. The monthly variation estimate for the retail sector (not including wholesale or transportation of goods) was an especially robust +55k even though the manufacturing sector is and has been contracting. The dichotomy is particularly striking since retail sales have also been noticeably weak over the past year, sales which suggest recession not the robust hiring.

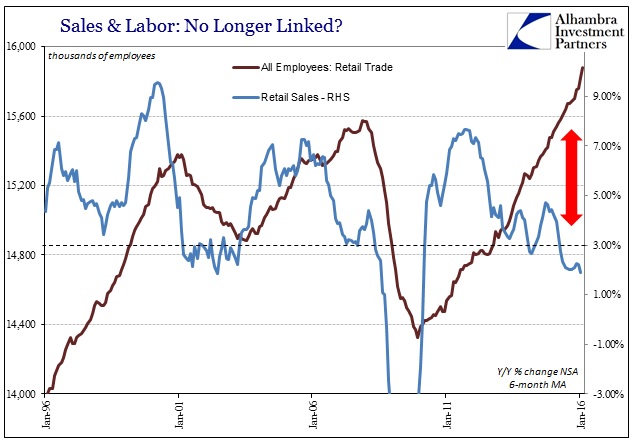

Overall retail sales, including auto sales, have not been in the range considered of a healthy economy since the summer of 2012, yet the BLS has figured the usual straight line advance in hiring and employment. Since a minor curtailment in the middle of the 2012 weakness and slowdown, the BLS suggests that an enormous 1.08 million retail jobs have been created even though retail sales have lingered at dangerously low levels the whole time. Retail sales during an evident growth period should be rising by 6% minimum, not near or below 3%. In fact, 3% growth has been uniformly associated with recession.

In the late 1990’s, retail sales were growing routinely at 7-9% until the dot-com recession. As you would expect, from early 1998 until December 2000, the BLS reports that retailers added 865k jobs total, or about 25.5k per month. That is only slightly more than the 24.5k per month the BLS gives us for the past three and a half years of almost recessionary retail sales. As retail sales have sunk only further over the past year or so, the BLS instead somehow shows an enormous acceleration in retail trade jobs even better than the late 1990’s.

Starting April 2015, overall retail sales (again, including auto sales) fell below 3% on a 6-month average basis (meaning more than a one-month drop in growth rate) – and have remained closer to 2% than even 3%. In past cycles, that has meant initiation of contraction in retail trade employment and widespread recession. Not this time, however, as the BLS gives us a remarkable +313k gain (including February 2016) over the last 11 months. That equates to an astounding 28.5k per month.

Leave A Comment