Retailers Helped By Tax Bill

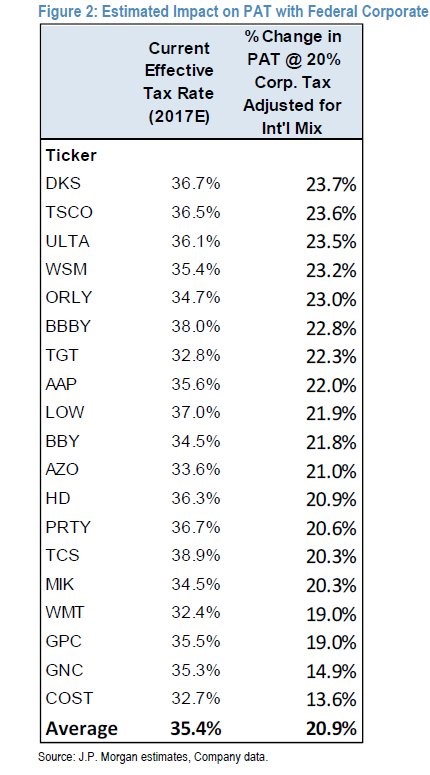

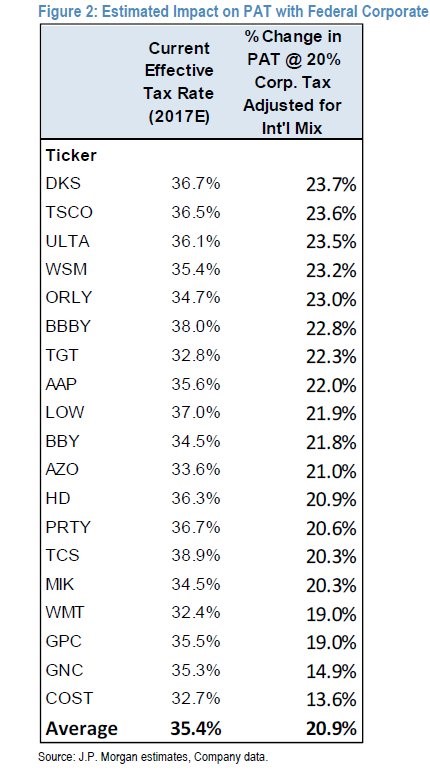

The stock market indexes reflect the tax bill’s impact on earnings as the Dow rallied, while Nasdaq fell. The Dow was up 0.24%, the S&P 500 was down 0.12%, and the Nasdaq was down 1.05%. Many of the retail names did well because they have high tax rates. Gap stock was up 6.6%, Macy’s was up 6.7%, and O’Reilly Automotive was up 6.8%. The table below reviews some of the names which will be getting a big tax break next year after the bill is passed. As you can see, O’Reilly Automotive will see its tax rate go from 34.7% to 23.0% assuming the corporate tax rate is cut to 20%. When looking at these names, it’s important to find the ones with staying power. Lower tax rates don’t matter if the company can’t make a profit. The companies on this list which probably won’t be bothered by Amazon are AutoZone, O’Reilly Automotive, and Home Depot. The companies which will be bothered by Amazon are Bed Bath & Beyond, Target, and Wal-Mart. At least Wal-Mart has Jet.com to help it compete online.

Yield Curve Signals Investors Should Be Careful Buying Retail

One aspect to keep in mind is that consumer discretionary stocks do badly at this point in the yield curve. That’s because when the yield curve is as flat as it is right now (57 basis points), there is usually inflation. Inflation increases the cost of goods sold for retailers and hurts the spending power of the consumer. In the past two cycles, gas prices went up at the end of the cycle which hurt retailers. High gas prices accelerate the market share loss of physical stores to online stores as online stores don’t require people to drive to buy items; shipping is usually free when customers buy online, especially for Amazon Prime members.

Low Oil Prices Have Helped Retail & High Tax Rates Have Hurt It

Let’s look at the competitive advantage between online and physical retailers when it comes to these recent trends. There’s no question the technology improvements from online stores means they will gain share over time. However, these two factors which are oil prices and tax rates effect the speed of the shift. When consumers see the price of gas, they are psychologically impacted more than they should be when you consider the share of their spending gas represents. When they see $4 gas, they get shell shocked and drive less. That means even though Amazon might need to swallow higher shipping costs, it still comes out ahead. Of course, retailers also need to ship the goods to the stores, so higher diesel prices hurt their margins. Therefore, retailers have been helped by low oil prices in the past two years; they must be worried by the recent rally in oil.

Leave A Comment