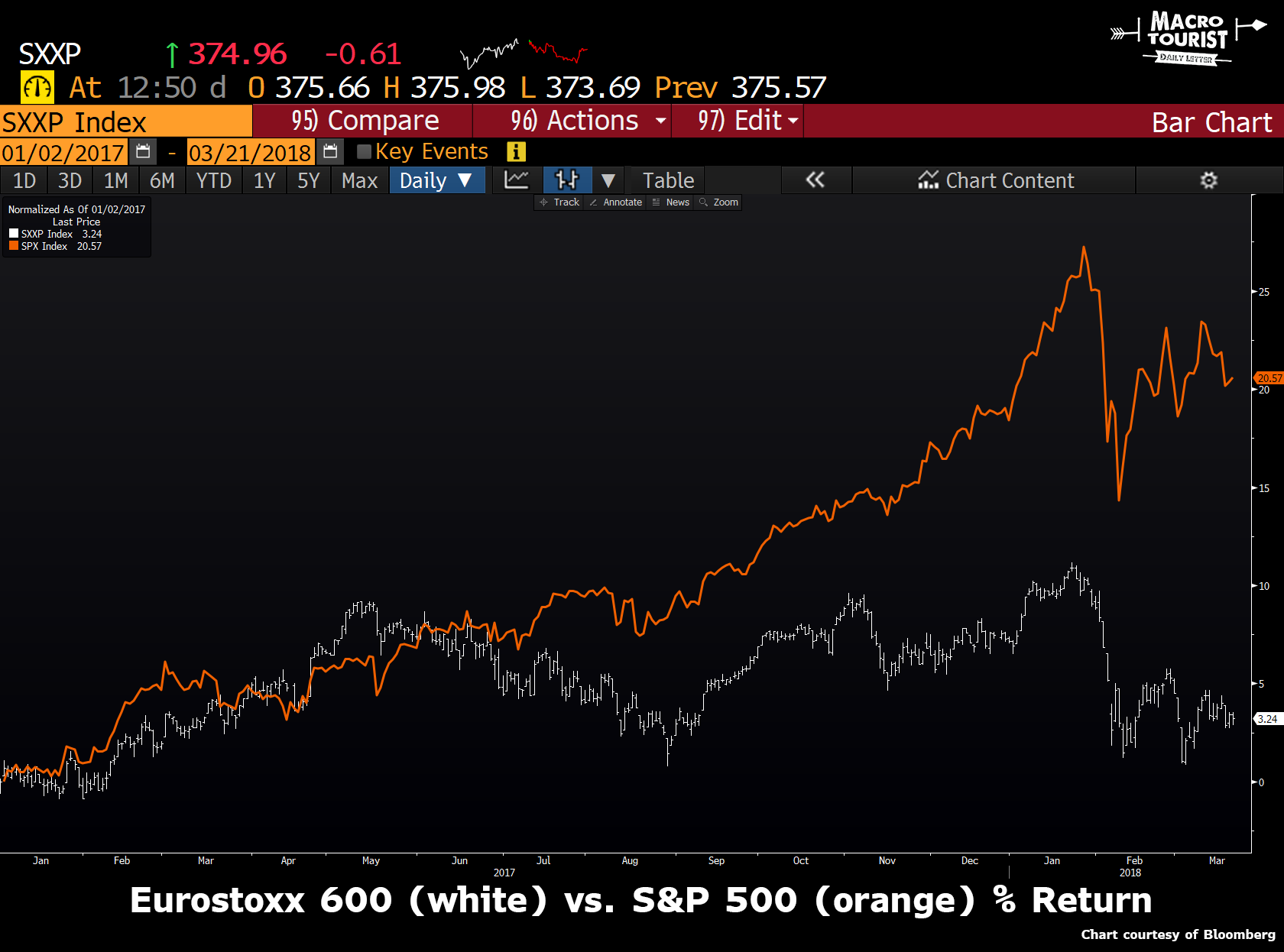

It’s tough to get excited about European stocks these days. Although they had a decent run in 2017, they were still trounced by their American counterparts.

It’s difficult to compete with the Trump tax cut excitement, and let’s face it, a steadily rising Euro is a tough headwind to sail into.

Although there has been all sorts of talk about global synchronized growth, the truth of the matter is that the European economy has been slowly rolling over for the past quarter. Have a look at this chart of the Citibank Eco surprise index of the American economy versus the Eurozone. This indicator measures economic activity versus expectations. As economic numbers are released that beat expectations, the index rises. Conversely, economic numbers that disappoint versus forecasts cause the index to fall.

The American economy started to underperform expectations in late December, but has since stabilized. Not so for the European economy. It has deteriorated at an increasing rate.

But is the US stock market outperformance and the Citibank economic indicator truly representative of what is going on in Europe?

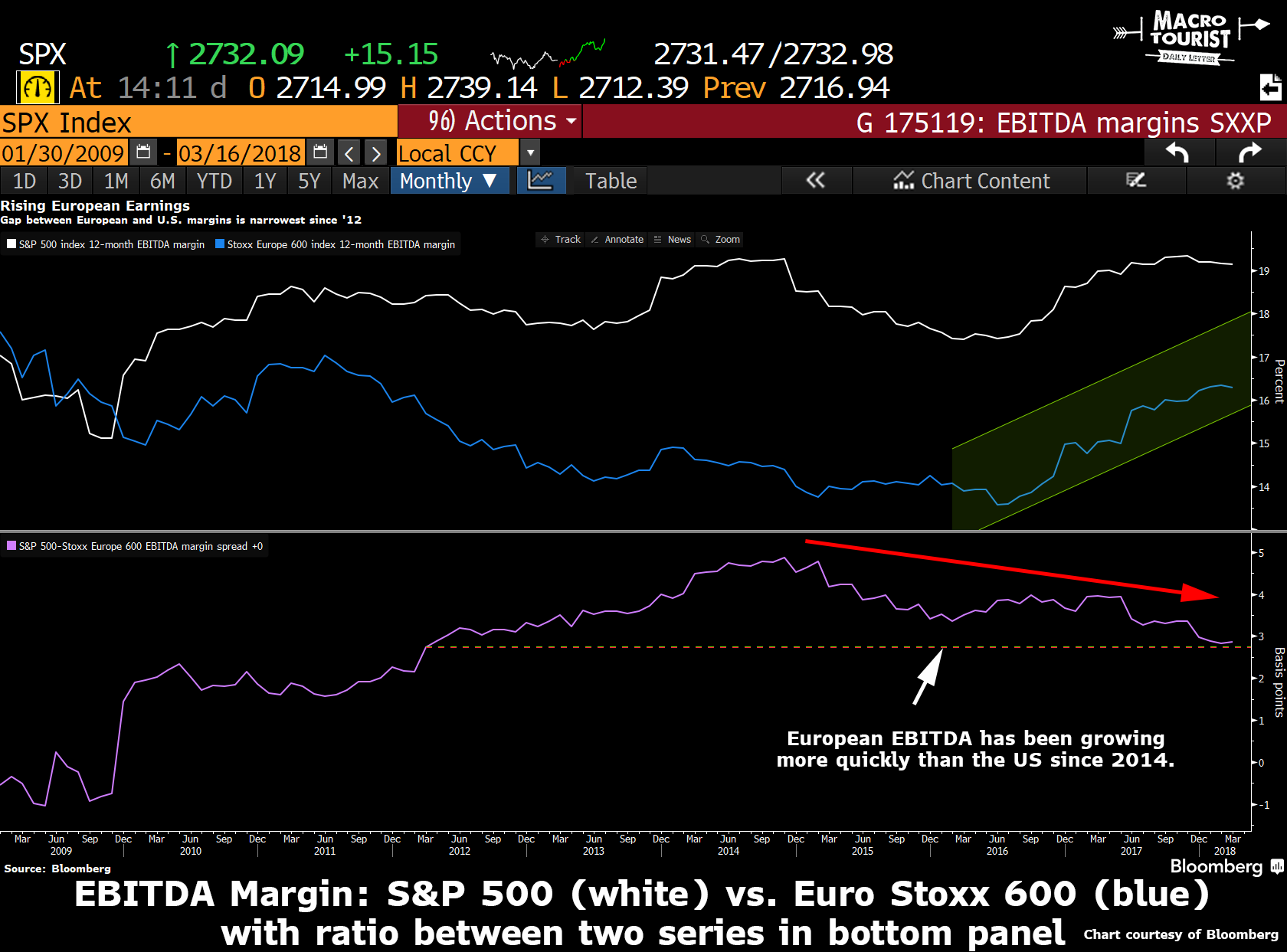

I was stunned by a recent chart created by Bloomberg reporter Ksenia Galouchko that showed the EBITDA trend of the S&P 500 versus the EuroStoxx 600 over the past few years.

As might be expected, the EBITDA margins for Americans companies have vastly outperformed European ones since the Great Financial Crisis. Both countries’ margins slipped in 2009, but the US quickly rebounded while European companies lagged. I have my theories why this might be, but they are controversial. Europe suffered from an unnecessary economic slump that was the result of excessively tight monetary policies and severely restrictive fiscal programs (don’t forget that Trichet raised rates twice in 2011 only having to quickly retract those hikes as the European economy collapsed and don’t get me started about how tightening fiscal policy works in a balance sheet recession). But arguing about proper policy is useless, the real question is what is happening today and what might that mean for markets.

Leave A Comment