The federal budget deficit widened in the fiscal year 2017 to the sixth highest on record, creating a budget shortfall of $666 billion. That is up $80 billion, or 14%, from the fiscal year 2016. The overspend resulted primarily from an increase in spending for Social Security, Medicare, and Medicaid, as well as higher interest payments on the debt due to rising rates that drove up outlays to $4 trillion, which was 3% higher than the previous fiscal year.

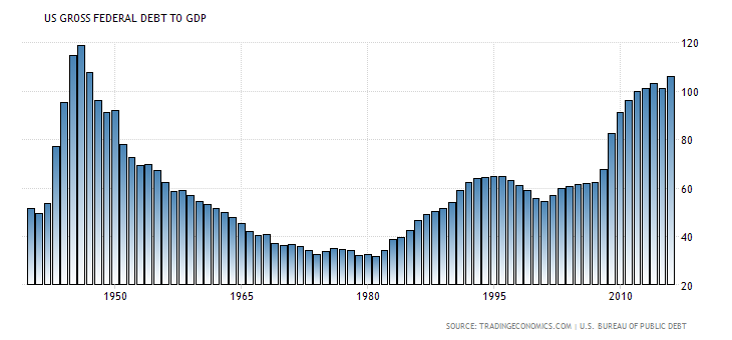

The deficit as a percentage of gross domestic product (GDP), totaled 3.5%, up from 3.2% the year prior. This budget gap will be piled on to the ballooning National Debt that in the fiscal year of 2016 grew to whopping 106% of GDP.

But the Trump administration isn’t spending a lot of time tweeting about the looming debt crisis. In fact, they would like us to believe that their recently proposed tax reform will not only pay for itself but will actually reduce debt and deficits. Treasury Secretary Steven Mnuchin noted recently that, “Through a combination of tax reform and regulatory relief, this country can return to higher levels of GDP growth, helping to erase our fiscal deficit.”

But the truth is that the proposed tax reform will not completely pay for itself–let alone reduce the deficit or pay down the debt. The Senate has recently congratulated themselves for approving a budget resolution that would allow Congress to collect $1.5 trillion less in federal revenues over the next ten years, yet they are still in search of new revenue to pass tax reform.

And since there are still some remnants of the fiscal hawks in Congress, Republicans are in a frenzy to find new revenue opportunities to get the necessary votes; in search of an elusive “sacred cow” that isn’t that sacred.

Following the election of Donald Trump, the House supported a Border Adjustment Tax (BAT); a cash windfall that dovetailed brilliantly with Trump’s America first agenda. However, it didn’t take long for lobbying groups to crush that proposal, and the BAT tax wound up biting the dust.

Leave A Comment