Sink Your Fangs

It seems like many of Wall Street’s favorite stocks had something weighing down on them, I mean, other than the massive personal data revelations and upcoming regulatory crackdown.

Google, lost a case against Oracle and may be liable for $8.8 Billion in copyright infringements.

Tesla and Nvidia plunged as they were forced to halt progress on their self-driving cars after a recent fatal incident.

Twitter has fallen more than 12% as they plan to implement their bitcoin advertising ban today. Not saying the two things are connected, but look at what happened to Facebook shortly after they banned crypto ads.

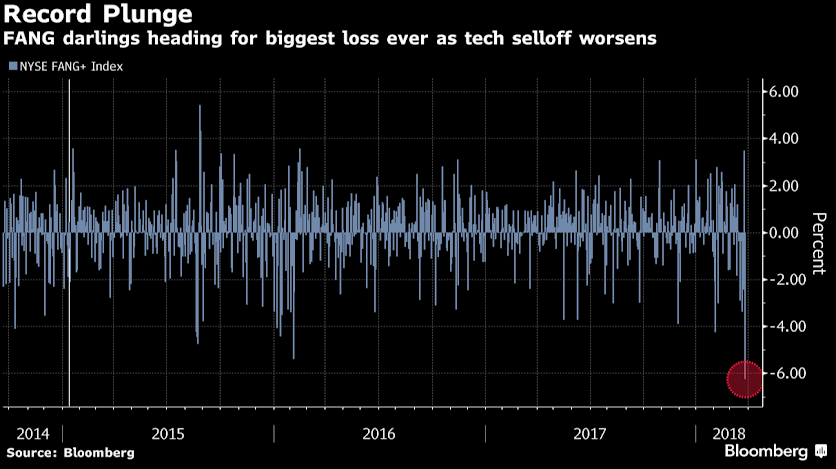

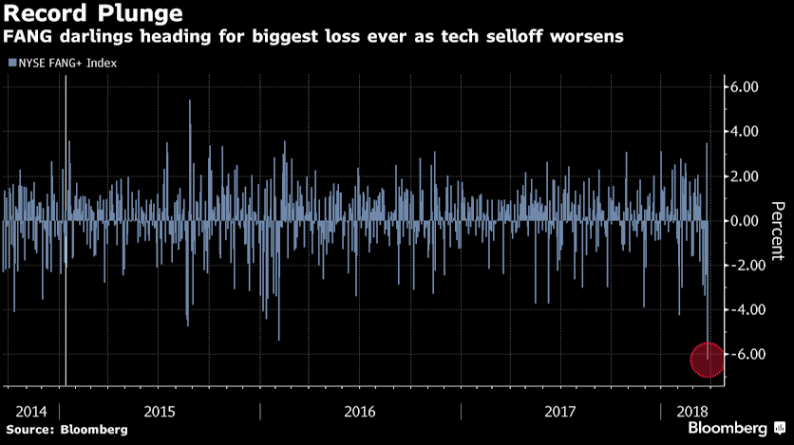

Kidding aside, in this chart we can see the daily performance of the FANG+ index, which has just seen it’s worst day in history.

What’s Happening?

It’s going to be difficult for most fund managers to end the week in profits. With just 2.5 trading days left in the quarter, this is not going to look good on the books.

In the famous words of FDR, the “only thing we have to fear is fear itself.”

Fear can be pretty powerful sometimes, especially with everything that’s been happening in the news and geopolitics lately. The question that investors are asking themselves is where will the markets be at the end of the year.

If the answer that they come up with is anything less than 2.5% up, then they will likely shift their funds to someplace else. Most likely into bonds.

This is exactly what happened yesterday and we can see a sharp move downward in the 10-year yield as investors made the switch from stocks to bonds.

In eToro, there are two assets that you can add to your portfolio if you feel that this dynamic may intensify.

The TLT is the 20 year US treasury bond and the BOND ETF on the platform is a managed bond fund from Pimco.

If you want to make a play at the volatility. Gold has been acting as a strict safe haven during the most recent stock plunges and the VXX is designed to go up when there is short-term volatility.

Leave A Comment