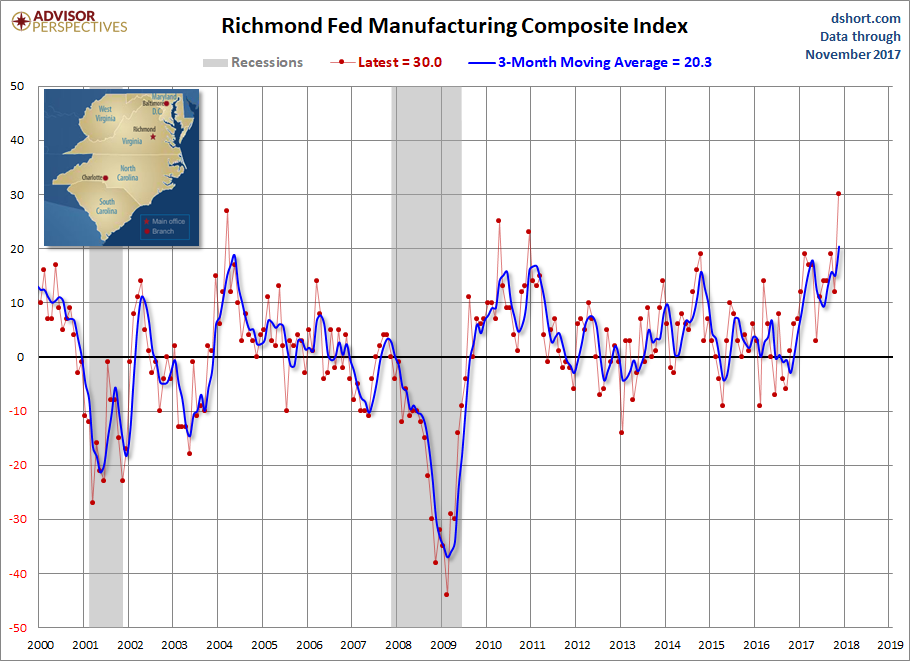

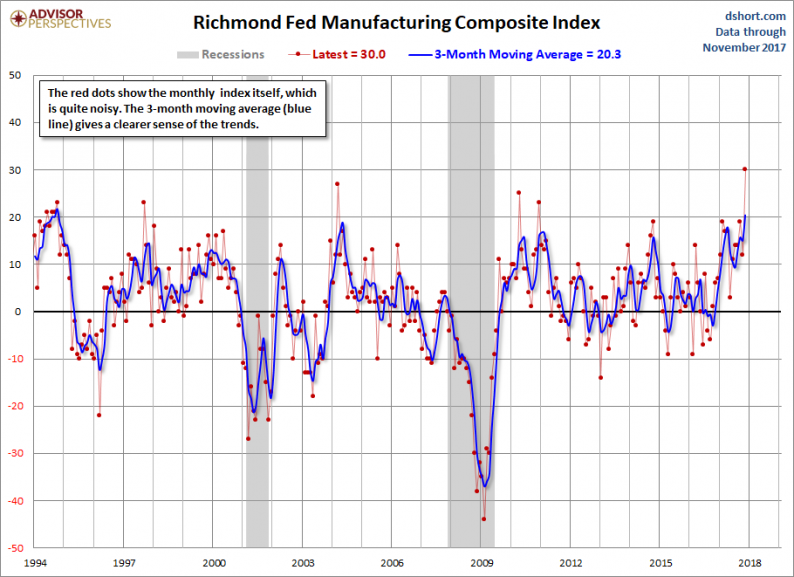

Today the Richmond Fed Manufacturing Composite Index was at 30 for the month of November, up from last month’s 12. Investing.com had forecast 14. Because of the highly volatile nature of this index, we include a 3-month moving average to facilitate the identification of trends, now at 20.3, which indicates expansion. The complete data series behind today’s Richmond Fed manufacturing report, which dates from November 1993, is available here.

Here is a snapshot of the complete Richmond Fed Manufacturing Composite series.

Here is the latest Richmond Fed manufacturing overview.

Manufacturing firms reported robust growth in November, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index jumped from 12 to 30, the highest it has been since 1993. This rise was bolstered by strengthening conditions across all three components of the index. While indicators of current wages and finished goods fell in November, both maintained positive values, dropping from 24 to 21 and 14 to 9, respectively.

District manufacturing firms remained optimistic that growth will continue in the coming six months. But a smaller share of firms raised their expectations than had in October in all areas, except for wages and capital expenditures.

Manufacturing firms reported stronger price growth in November, as growth rates for both prices paid and prices received reached a three-month high. They expect prices to continue to grow in the next six months but at a slightly lower rate. Link to Report

Here is a somewhat closer look at the index since the turn of the century.

Is today’s Richmond composite a clue of what to expect in the next PMI composite? We’ll find out when the next ISM Manufacturing survey is released (below).

Because of the high volatility of this series, we should take the data for any individual month with the proverbial grain of salt.

Leave A Comment