Gold prices fell $9.66 an ounce on Tuesday as a rally in the U.S. dollar index curbed demand for the yellow metal. Global trade tensions and emerging market concerns were also bearish daily elements for the yellow metal. In economic news, the Institute of Supply Management said its manufacturing index rose to a reading of 61.3 in August, up from July’s reading of 58.1. XAU/USD tested the support at around the $1291 level after prices dropped below $1296.

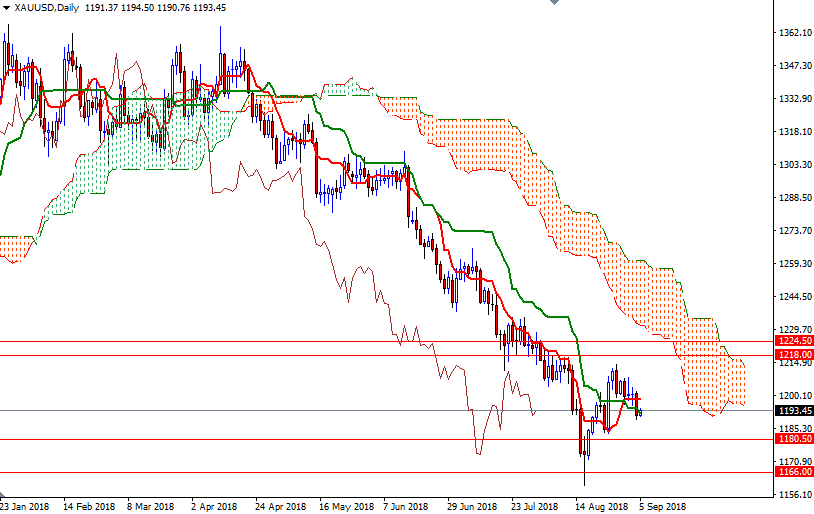

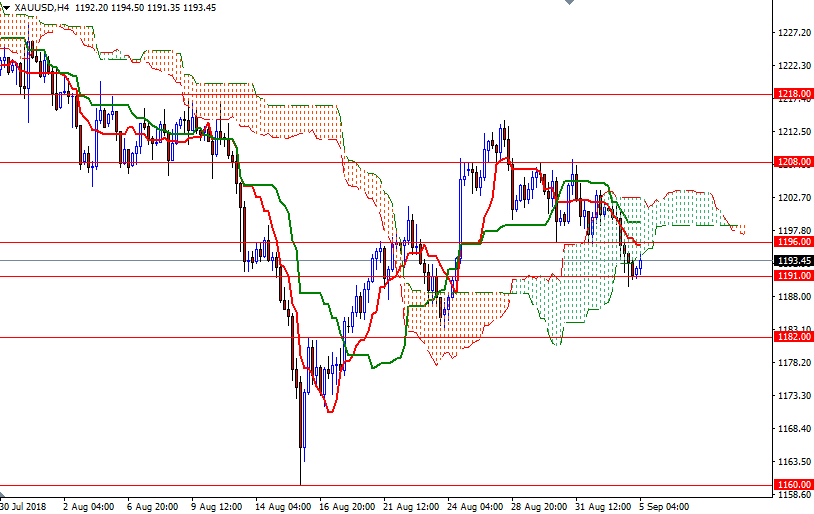

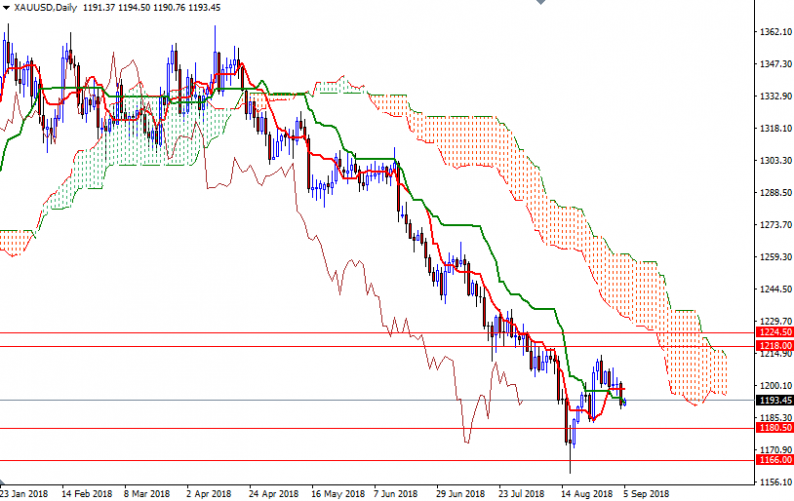

Gold prices seem vulnerable to the downside as the market continues to trade below the weekly and the daily Ichimoku clouds. The Chikou-span (closing price plotted 26 periods behind, brown line) is also below the cloud. The 4-hourly clouds is sitting right on top us, and it is acting as a resistance at the moment. The bulls have to lift prices above 1197/6 if they intend to challenge 1199, the Kijun-Sen (twenty six-period moving average, green line) on the H4 chart. The top of the 4-hourly cloud resides in the 1204/3 area so a break through there is essential for a bullish continuation towards 1208.

However, if the bears drag prices below yesterday’s low, it is likely that XAU/USD will retreat to 1186. A break below 1186 implies that the 1282-1180.50 area will be the next stop. The bears have to produce a daily close below this strategic technical support to challenge 1176 and 1173/2.

Leave A Comment