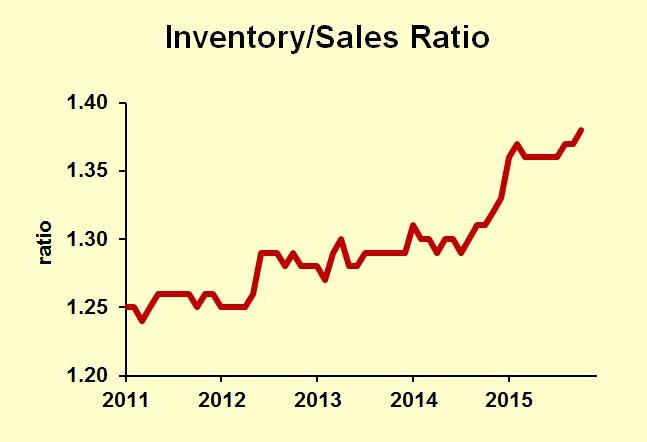

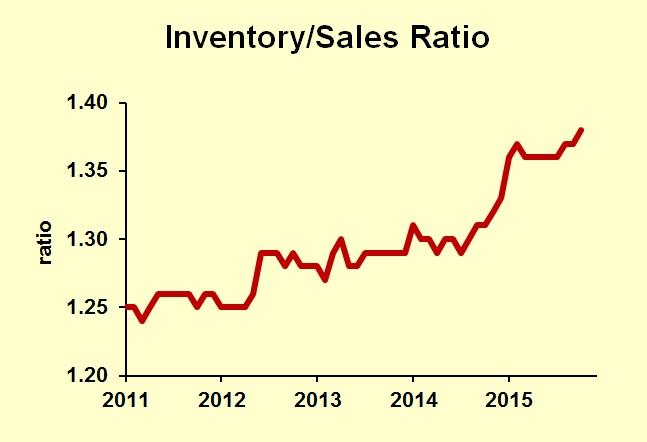

Inventories are rising—and that’s scary. After a very long-run trend of leaner inventories, companies are now holding significantly more than they did just four years ago. Excess inventories are an easy way to go bankrupt, so this movement deserves attention.

At the end of 2011, companies held $1.26 worth of inventory for every dollar’s worth of monthly sales. Their holdings now amount to $1.38. (Inventory data.) As an economist I cannot know what the right level of inventories is. Careful decisions don’t bother me, but I’m not convinced that careful is more common than complacent.

Companies have been trimming inventory levels for many years. Twenty years ago businesses held $1.49 of inventory for every buck of monthly sales. With improved technology, companies today know what is in the store, what’s in the warehouse, when new supplies will be delivered, and what’s delayed in shipment. Walmart gets—and deserves—a lot of credit for better inventory management, but good practices have spread across the entire economy. So why the recent reversal?

Inventories spike up whenever the economy goes soft, but that’s not really the case in the last four years. The recent upward trend is present at all levels: manufacturing, wholesale and retail.

Maybe companies went overboard in lean inventories after the last recession. Possibly they figured that they were losing sales and have made a conscious decision to have more stock available. In fact, I wrote about companies losing sales due to low inventory back in 2009.

More likely is that inventories have risen because of complacency. Sales have grown at a moderate pace, not great but not bad. Few businesses are in crisis. Interest rates are low, so it does not cost much to tie up working capital in inventories. This is a breeding ground for complacency.

If the economy does stutter, the inventories will have negative effects on individual companies and the overall economy. At the company level, a weak economy will reduce cash flow, making companies wish that their inventories consisted of cash rather than goods. At the economy level, businesses with excess inventories will stop ordering more materials from their suppliers, triggering a more severe turndown that otherwise would have occurred.

Leave A Comment