“Davidson” submits:

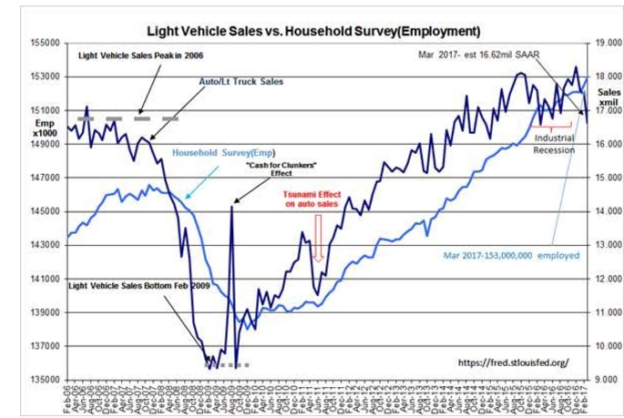

A single month’s vehicle sales disappoint trader’s expectations and they call for recession! Bloomberg-Danger of Sell Off as Auto Sales Disappoint. Employment reports remain on trend. Pessimism is not justified. While it may seem I am a ‘Perma-Bull’ (I have been bullish since Dec 2008), I assure you I am not. When well-documented indicators turn negative, so will I. Now is not that time.

Measuring economic activity is a statistical process. Previous monthly reports are always revised with following reports.

Bureau of Labor description

“The household survey and establishment survey both produce sample-based estimates of employment, and both have strengths and limitations. The establishment survey employment series has a smaller margin of error on the measurement of month-to-month change than the household survey because of its much larger sample size. An over-the-month employment change of about 100,000 is statistically significant in the establishment survey, while the threshold for a statistically significant change in the household survey is about 500,000. However, the household survey has a more expansive scope than the establishment survey because it includes self-employed workers whose businesses are unincorporated, unpaid family workers, agricultural workers, and private household workers, who are excluded by the establishment survey. The household survey also provides estimates of employment for demographic groups.”

The important news with employment is that the industrial recession which was caused by the strong US$ 2014-2016 appears to have ended. Hiring is picking up. I use the Household Survey as it is the most comprehensive of all surveys. It is the trend not the specific monthly number which is important.

The economic indicators remain positive and so do I. Every period of higher pessimism since Dec 2008 has proven to have been a decent buying period for investors. Nothing has changed with the fears that vehicle sales topped Last month. One months data point in a single data series is meaningless if not viewed long-term and in the context of other important economic measures. Regardless of where investors fall on the optimistic-pessimistic spectrum, market psychology has no impact on economic trends.

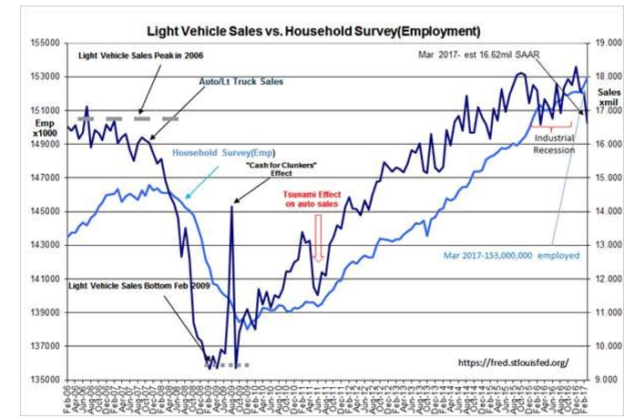

The more important economic indicator is the T-Bill/10yr Treas rate spread moving below 0.2%(flat yield curve). What has historically driven an over-levered economy into recession is a flattening yield curve which takes away ‘the cookie jar’ after a multi-year period of excess. Think of Lucy taking away the football just as Charlie Brown attempts to kick it as hard as he can. Once this conditions occurs, highly levered enterprises suddenly lose their cash flow support. An economic correction ensues and a market correction follows.

A T-Bill/10yr Treas rate spread below 0.2% has been most often caused by excessive market speculation as investors sell T-Bills to chase market/business returns which they believe to are ‘guaranteed’. It is when we believe most that we are taking ‘no risk’ that investors behave like this. It is the iconic mark of market tops. The data can be tracked back through 1953.

The Long-Term Monthly History of T-Bill/10yr Treasury Rate Spread vs. Recessions

The daily T-Bill/10yr Treas Rate Spread has drifted lower with the build of recent market pessimism. Importantly this has occurred with falling 10yr Treasury rates and not by a sharp rise in T-Bill rates. Even so, the T-Bill/10yr Treas Rate Spread remains 1.55% which is well above the 0.2% threshold. The lending pace has likely slowed from 3mos ago, but it remains much better than when the spread was 1.09% in July 2016. Market psychology ebbs and flows during the business cycle and is reflected by the T-Bill/10yr Treas Rate Spread.

Recent Daily T-Bill/10yr Treas Rate Spread

The economic evidence supports an economy which has adjusted to the strong US$ and exited the 2014-2016 industrial recession. The strong US$ impacted oil companies (commodity producers) and related industrial sectors which are high-value exports for the US. Employment declines of 6%-8% were experienced in these high wage industries. Even with the US$ remaining relatively high, these industries show signs of recovery. Vehicle sales, new home sales and retail sales should benefit going forward.

The Mid-East Issue

The strength of the US$ the past several years was correlated a significant capital shift to Western nations with strong property rights protections. There were two aspects to this capital shift. The first was capital seeking safety from autocratic governments which emerged the past several years. US withdrawal as force supporting global Democratic principles led to the rise in terrorism, ISIS and non-Democratic behavior. As a result capital sought safe havens in Western nations driving real estate prices to historic levels while at the same time driving Sovereign debt yields to 5,000yr lows. This was not capital seeking returns but legitimate capital for which safety was more important than returns. The second aspect to the capital shift had a similar goal but different reason for seeking Western property rights protections. Two major governments are in the process of countering decades of home-grown corruption, Brazil and China. The transfer of wealth to Western nations from China alone has been estimated to be more than ~$4TrillionWhy China Lost About $3.8 Trillion To Capital Flight In The Last Decade

The long-term history of the US$ suggests it should be 30%-35% lower vs. Trade Weighted Major Currencies as it returns to trend. The administration’s actions towards reasserting the US as the traditional defender of Democratic principles is likely to cause this normalization. If this occurs, it will take 5yrs-7yrs. It would be an added positive for US commodity sector, related industrials and Intl Equities as capital flows return to developing and emerging markets.

The current investment climate remains favorable for LgCap Domestic, Intl and Natural Resource related assets in my opinion.

Leave A Comment