The US Central Bank hiked benchmark rates last week for the 8th time since their tightening cycle began in December 2015. Starting from the all-time low of .25%, the federal funds rate now tops 2%+ for the first time in a decade.

In the longer run, higher rates are critical for a stable financial system that’s dependent on savers and productive investment. On the flip side though, corporate and consumer credit, that’s priced off the fed funds rate, has now seen this relative cost of carry leap 800% in 33 months. This is no small matter for a world today servicing the highest debt levels in history.

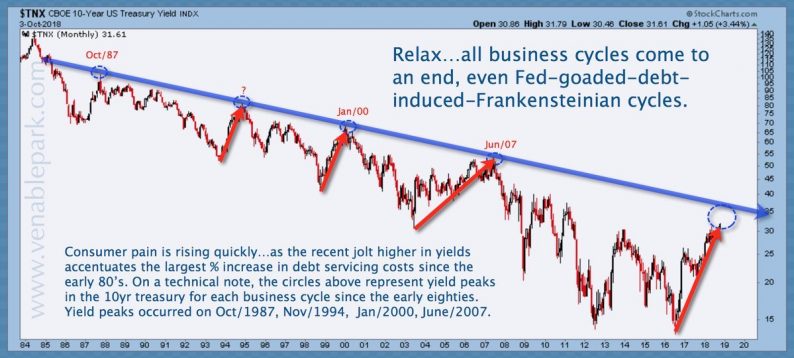

Accommodative central banks stoke debt-fueled expansions, and then they take them away. The latter’s happening now. As shown below in my partner Cory Venable’s chart of the 10-year Treasury Yield since 1984, lesser relative rate spikes preceded the onset of consumption contractions (recessions) and stock market downturns in the much-less indebted peaks of 1987, 2000 and 2007. Central banks are pretending not to know this, maintaining their perennially optimistic growth forecasts, because they’ve boxed us into low-rate purgatory with no painless paths out.

The truth is that today more than ever before, rising rates will drown debt-encumbered economies and central banks will seek to ease once more. By then though, the necessary hit to spending and employment, as well as stock and corporate debt markets, will already be done. We should beware of false prophets expecting unprecedented outcomes.

Leave A Comment