I am seeing more and more analysis reporting things like ‘my proprietary indicators have gone positive’ or ‘market risk has now cleared according to my indicators’ and so on and so forth. You’re about a month too late there guys.

A market bounce was almost pre-coded due to sentiment that got way over bearish in January and February. Indeed, in NFTRH we planned for a counter trend rally that sure took its time in arriving; but arrive it finally did. That was because sentiment was so bearish that every bounce attempt was being sold by risk averse players, both human and machine.

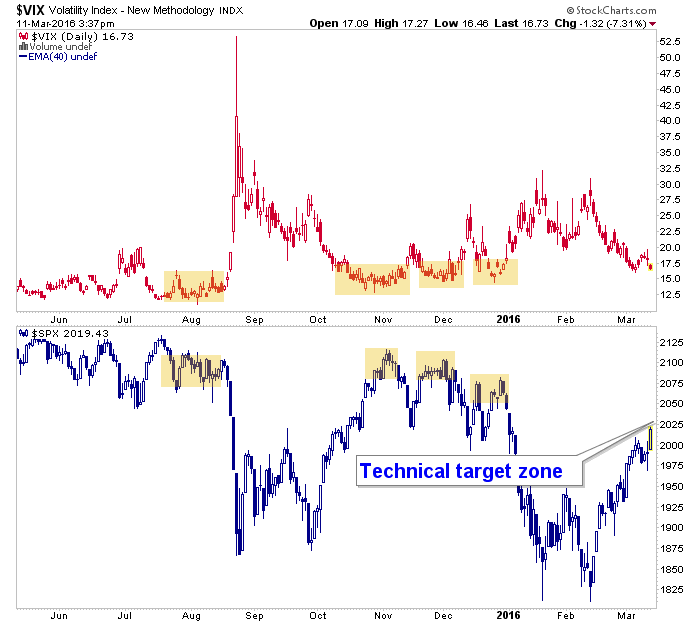

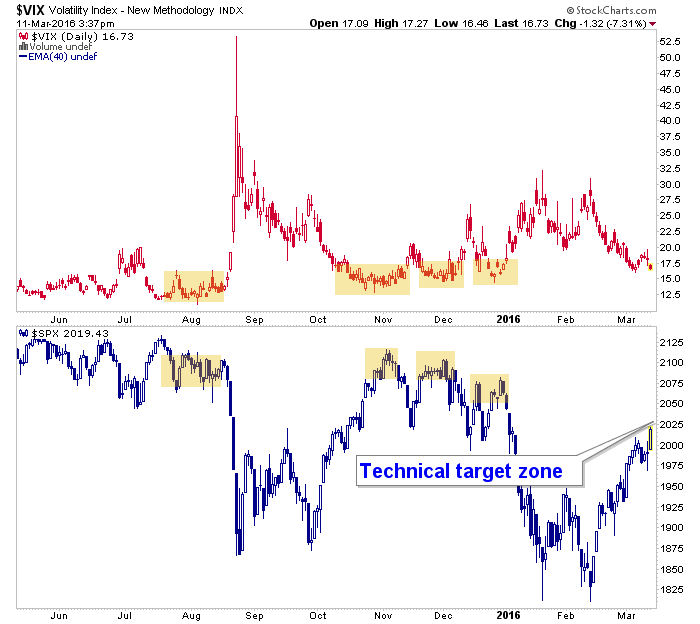

Not so today as players once again rebuild their backbones. Statements like those above are simply the product of trend following systems giving the all-clear. The nature of markets is that most participants have to be wrong at turning points, after all. While the VIX can lay on the floor for incredibly long periods of time during bullish phases, during a reaction like this one (and the post-September bounce) it is a big caution signal when market players are so content. At least that is what it has been for the last 3 such instances. Just FYI dear newly brave bulls.

Show me technical repairs to the stock market and maybe I’ll start to believe that the VIX can go back down for the count like in the good old bullish days. Meanwhile, I am playing it for what it is, a bounce to renew sentiment. Can SPX exceed the 2000-2030 target? Yup. Is risk high? Yup, and it is precisely because players no longer perceive it to be.

Sentiment is not yet bullish to an extreme, but we’ve got time. I still recommend people stay balanced in what ever form that works best.

Leave A Comment