The purpose of the capital markets is to allocate capital to its most efficient use. Research on economies around the world shows that functioning capital markets are positively correlated with economic growth. The more liquid and efficient the stock market is, the more the entire economy thrives.

Since capital markets exist to maximize allocative efficiency, we would expect the agents of capital—corporate executives—to focus on that goal. Yet, we know they do not. There are simply too many disincentives, such as huge bonuses tied to performance metrics that do not resemble shareholder value creation, including

Not only do these metrics do a poor job of representing efficient capital allocation and value creation, they are also easily manipulated. A recent survey of CFO’s featured on MarketWatch showed 20% of companies misrepresent earnings by 10% or more, and, importantly, that Wall Street analysts do nothing about it.

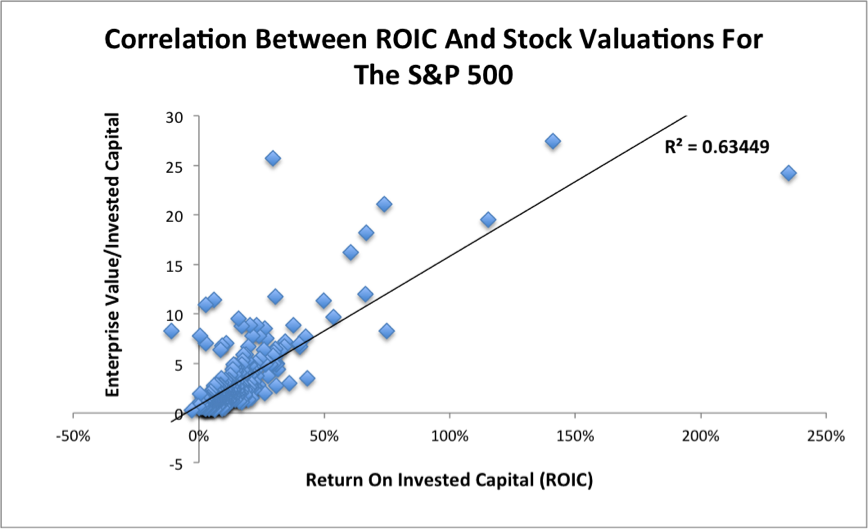

It’s incredible that corporate executives and the market as a whole continue to depend on such flawed numbers when we already have a measure that is clearly linked with value creation: return on invested capital (ROIC). Figure 1 shows that ROIC has a clear and strong link to valuation for S&P 500 stocks.

Figure 1: ROIC Has The Largest Impact On Valuation

Sources: New Constructs, LLC and company filings.

This strength of this relationship is intuitive. If the purpose of capital markets is to promote the most efficient use of capital, it makes sense that the market would reward companies that earn the most profit per dollar of capital invested with the highest valuations.

Why Aren’t People Using ROIC?

The merits of linking stock valuation to shareholder value creation are so obvious that many believe it’s already what “analysts” and “smart investors” do. When I got to Wall Street, I was shocked at how much resistance there was to using value-based metrics like ROIC and Economic Value Added (EVA). After I left Wall Street to start New Constructs, the first reaction from investors that I called on was “why would anyone need research from New Constructs when that’s what the Wall Street already analysts do?”

The truth is, Wall Street has a lot of incentives not to deliver shareholder-value based research at scale. Most importantly, that business model wouldn’t pay as well as the status quo, which is pretty great for the big investment banks. They are able to sell simplistic and conflicted research because, even though the market as a whole values ROIC, the majority of investors don’t take the time to dig this deep.

In 2005, Brian Bushee at the Wharton School of Business looked at the behaviors of institutional investors. Here’s what he found.

Given the success and growth of the online brokers over the last decade, we think Bushee’s analysis, if applied to the entire investor population, would show even fewer “Dedicated” investors and far more Transients today. Nevertheless, looking at his numbers, it becomes clear how simplistic research proliferates.

Leave A Comment