The fallout in liquidity and funding markets has been mostly suggested at the junk bond bubble. Prices have fallen, and many precipitously, while yields have risen. But those are not the only negative factors being exhibited. If the issuance figures are anywhere close to correct, then increasingly junk obligors are being totally shut out at any price. Worse than that, however, is that the damage is not contained in just junk bonds (and leveraged loans).

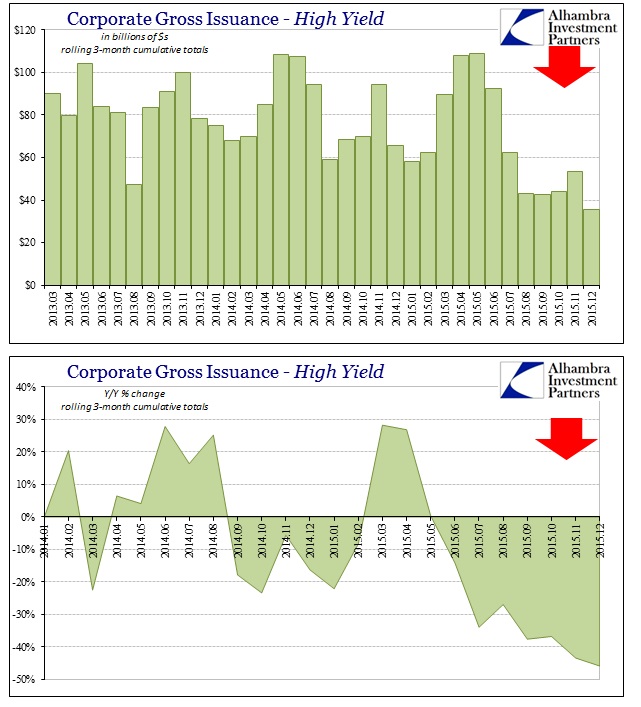

According to SIFMA, total gross issuance in December 2015 for high yield was just $3.5 billion – the lowest since August 2014’s $3.4 billion. For the quarter, gross issuance was down to $35.6 billion as compared to $65.7 billion in Q4 2014 and $78.4 billion in Q4 2013. That was the lowest three-month total in years. Clearly, the junk space is being pummeled by the gaining debacle in the junk bubble.

Investment grade issuance has also fallen off, however. SIFMA reports just $51.1 billion gross last month compared to $56.1 billion in December 2014. It is possible that IG issuance has declined as many companies rushed to float bonds earlier in the year, but the timing (August) of this small runoff (to this point) may suggest it wasn’t a planned function.

Further, there is initial evidence that other sectors are being affected, too. Gross muni issuance has also declined, if slightly, in recent months. Muni totals for December were $23.3 billion compared to $39 billion the December before. For the three months of Q4, there was gross of $81.7 billion vs. $91.2 billion Q3, $117.5 billion Q2, $108.1 billion Q1 and $105.5 billion Q4 2014. Undoubtedly, potential skittishness in the sector can be partially attributed to Puerto Rico’s unfolding default(s), but I don’t think that explains the full measure of the decline in gross; especially since that falloff occurred, like IG, suddenly after August last year.

If we are talking about finance in the context of recession, this is one of the primary recessionary forces. Companies in HY that suddenly are unable to roll or obtain bond financing or leveraged loans are left with few other choices given their status and presence in that market in the first place. Such credit-based liquidity in economic terms has undoubtedly kept many firms afloat that might have otherwise already succumbed to the insufficient economic expansion especially past early 2012. But as these firms start to default and layoff, they will do so in non-linear fashion which is what the crash in CCC suggests for the intermediate if not short term – once they start, look out.

Leave A Comment