Yesterday afternoon brought three salient statements from Washington financial authorities that boil down to a simple admonition. To wit, if you are still in the Wall Street casino, run don’t walk toward the nearest emergency exit.

We are referring first to the CBO’s warning that Uncle Sam will run out of cash by early March if the debt ceiling is not raised sharply.

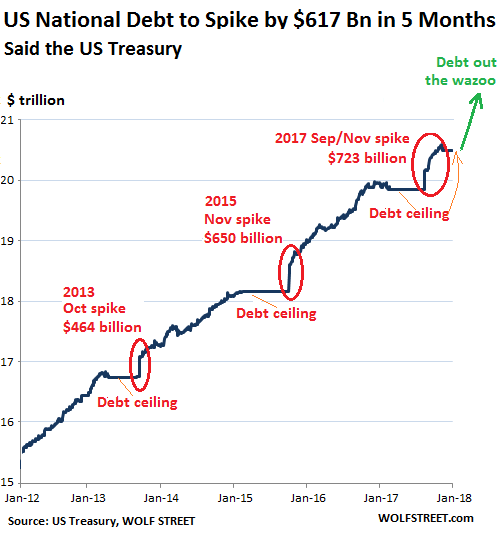

That warning was coupled, in turn, with the Treasury Department’s estimate that it will need to sell the staggering sum of $617 billion in new debt during the next five months. And, by the way, that short interval happens to include Q2 when the great annual fleecing of taxpayers causes a bulge in collections.

Finally, the Fed’s post-meeting statement assured that all is awesome with respect to the main street economy:

Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Gains in employment, household spending, and business fixed investment have been solid, and the unemployment rate has stayed low.

Whew!

After all, the following chart might have been unnerving in the absence of the FOMC’s glowing confidence that the US economy is stronger than an ox and therefore, presumably, capable of shouldering the current eruption of Federal red ink.

Still, a crucial question recurs: Just because the US Treasury is happy to march the public debt across the $21 trillion mark, it doesn’t mean there are 60 votes in the Senate or 218 in the House for the same.

So in light of the above discordance, we now commence some ruminations on how both ends of the Acela Corridor have ended up in an economic fantasyland like no other. Fittingly, the origins of the latter are squarely rooted in the Eccles Building, and the imminent departure of Janet Yellen, mercifully, provides the perfect jumping off point.

The above-quoted meeting statement is pure Yellen. That is, the ritual gumming of a Keynesian school marm which is utterly irrelevant to what the Fed is actually doing, and dead wrong besides.

The entirety of the four paragraphs statement consists of rubbery expressions of the Fed’s satisfaction that its goals for the labor market, inflation, and economic activity are unfolding nicely. The only fly in the ointment, of course, is that the Fed’s interest rate manipulations and balance sheet inflation have had almost no impact on the said objectives.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate ar 1-1/4 to 1?1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

We will address tomorrow why the Fed has been tilting at macro-economic windmills for years.

But first, it needs be noted that we are already at 2.00% inflation even by the BLS’ sawed-off measuring stick. During the last 12 readings, the year-over-year CPI has been at or above the Fed’s target 75% of the time, and has posted an average gain of 2.14%.

Leave A Comment