Despite the exit of U.S. from the Iran Deal there was no real damage done to the market. In fact, some indices are well positioned to benefit.

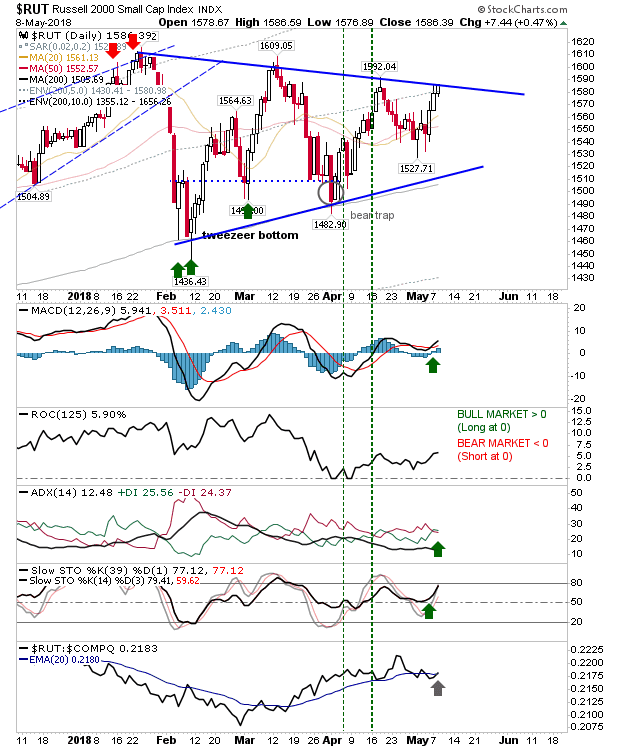

Best of these looks to be the Russell 2000. Today’s close left the index right against triangle resistance with a fresh MACD trigger ‘buy’ along with a similar trigger for the +DI/-DI. This helped tick relative performance in Small Caps favour.

I haven’t mentioned much about Breadth indices but the Nasdaq Bullish Percents generated a breakout – bullish for the Nasdaq and Nasdaq 100.

The Nasdaq did benefit with a bullish cross in On-Balance-Volume, ADX, Stochastics and higher volume accumulation plus a continued acceleration in relative performance – all leaving technicals net bullish.

It was the same story for the Nasdaq 100.

The S&P is another index readying for a breakout. Today’s narrow doji also finished up against channel resistance. There was some technical improvement with a new ‘buy’ trigger in the MACD but still waiting for new ‘buy’ triggers in Stochastics and ADX.

While the Dow Jones has the benefit of ‘bull flag’ shaped above channel resistance to help mark the bullish setup.

For tomorrow, watch the Russell 2000, S&P and Dow Jones Index for some upside follow through. While indices could push lower there isn’t really a short trade on offer (unless you want to short the channel tests for the S&P and Russell 2000). The fact indices didn’t sell off the U.S. exit of the Iran deal suggests traders should perhaps be ‘buying the news’.

Leave A Comment