The S&P broke higher to confirm a ‘bear trap’ and also closed at a new all-time high. Volume climbed to register an accumulation day but there were further losses in relative performance and continued losses in the MACD.

The Nasdaq posted a gap-driven 1% gain to bring it ever closer to channel resistance. It hasn’t yet tagged resistance but it looks well placed to do so by the end of the week. Technical are all bullish.

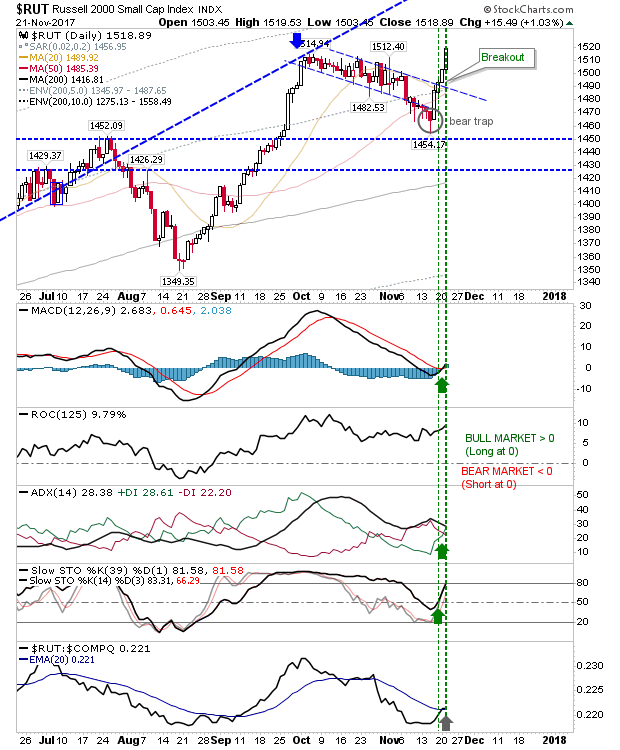

The Russell 2000 drove a 1% gain (which looks better than it ordinarily might have looked). Technicals are net bullish with a MACD trigger ‘buy’ to support the earlier +DI/-DI ‘buy’ trigger. It’s looking better for a move to challenge former support-turned-resistance; a move which if it was to play out would take until Spring 2018 to reach.

The runaway Semiconductor Index returned to its winning ways with new all-time highs.There really hasn’t been many trading opportunities besides the September breakout. Today’s gap higher may rank as a tradable play but given what has come before it remains vulnerable to a big profit take move.

Tomorrow will again be about consolidation. However, with the majority of markets at new all-time highs there is no room for shorts to hide and those who haven’t covered will have to very soon. Aside from existing longs I don’t see too much in the way of short term opportunities.

Leave A Comment