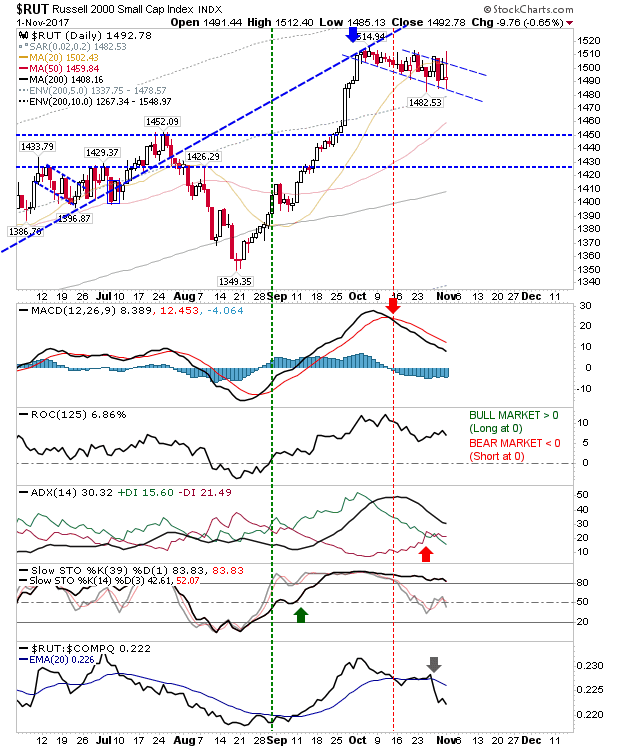

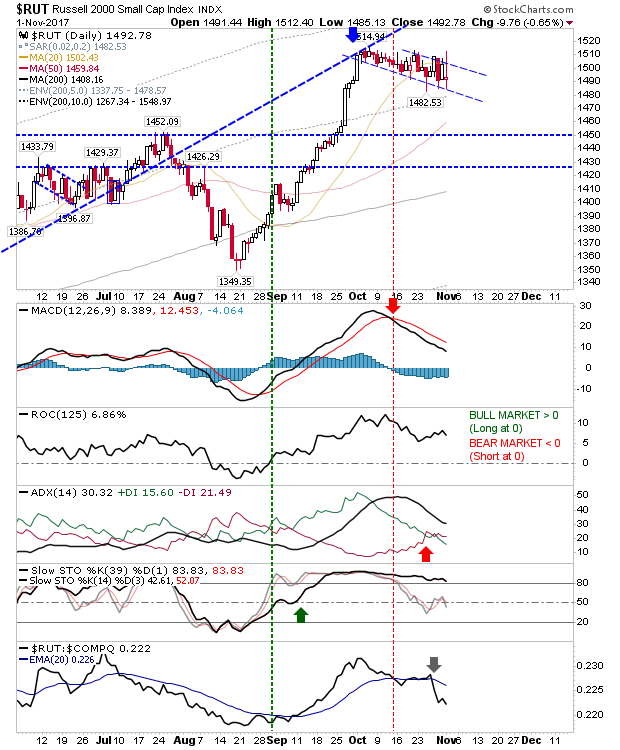

Sellers made a return but it wasn’t anything too damaging. The Russell 2000 had attempted a ‘bull flag’ breakout but was rebuffed to fall back inside the consolidation and close to yesterday’s lows. This still looks to be mapping a consolidation and it may need a test of the 50-day MA to drive a fresh rally. The only concern is the rapid loss in relative performance but everything else looks okay.

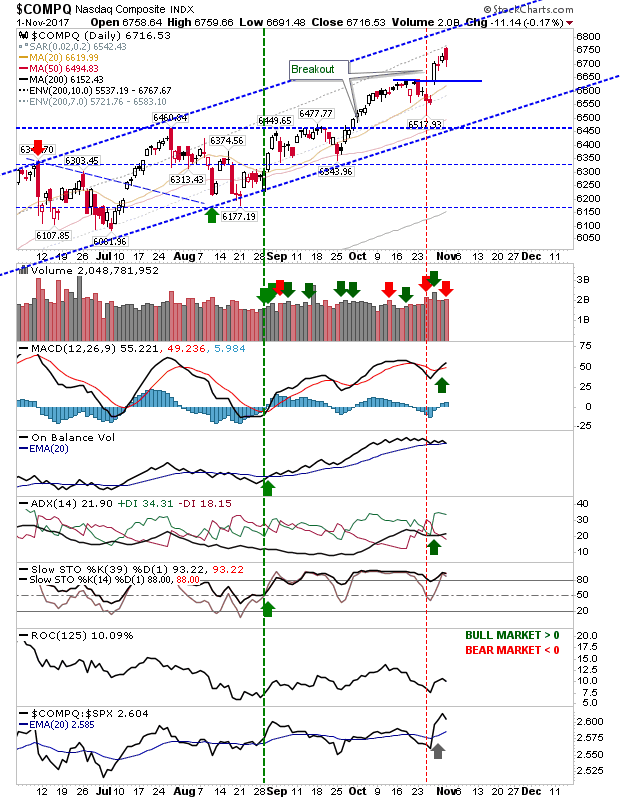

The Nasdaq suffered the largest profit taking episode as it clocked up a distribution day on a bearish ‘cloud cover’. This occurred away from resistance so it may not be too damaging but it could be the start of yet another pullback.

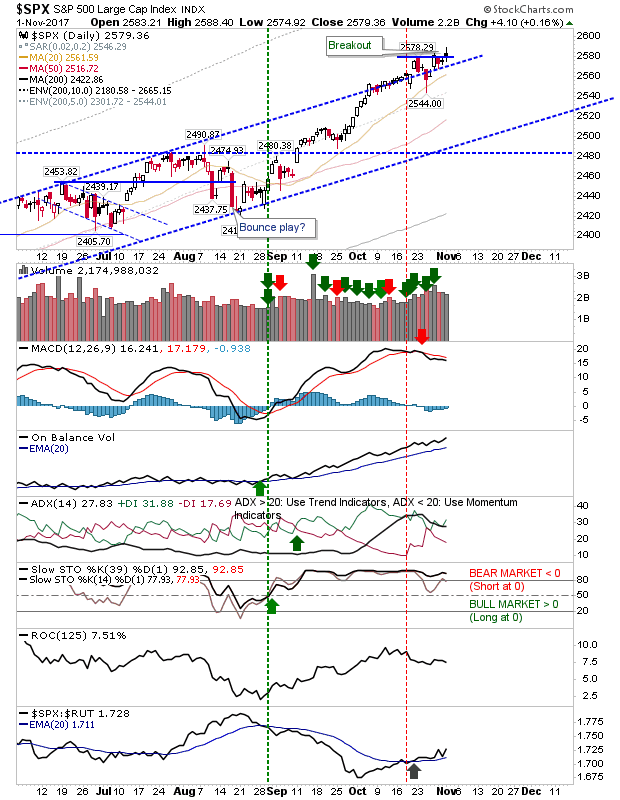

The S&P had a relatively tight day on light volume. It’s on the upper part of a breakout but not far enough past new support to confirm as one.

What’s helping both the S&P and the Nasdaq is the stronger relative performance of the index compared to the Russell 2000.While this relationship remains intact money flow should favor Large Caps and Tech and therefore a continuation of their rallies.

Leave A Comment