The index-to-watch for Monday was the Russell 2000 and while it didn’t really excite it did suffer a net bearish turn in technicals. On the positive front, it held on to its 50-day MA for a third day in a row. There may still be enough for bulls to reverse the bearish technicals but there is little room for maneuver.

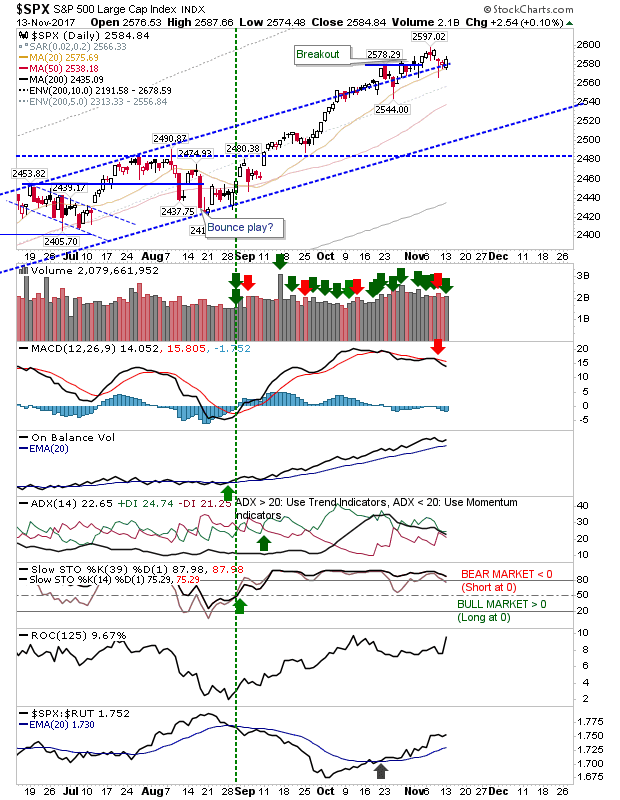

The S&P is able to mount a defense of former resistance turned support using the convergence with the 20-day MA as the bullish kicker. Volume climbed in bullish accumulation.

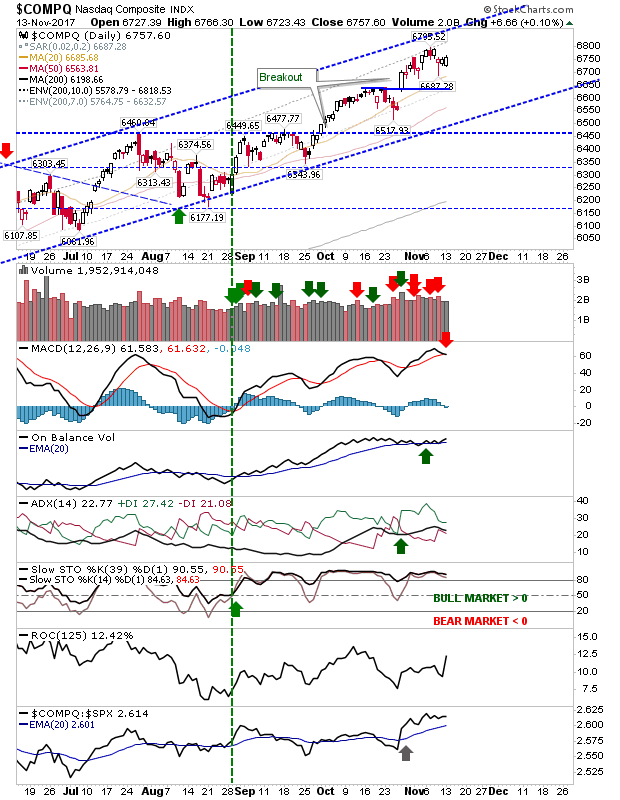

The Nasdaq remains inside its rising channel and is on course to tag rising channel resistance. There was a ‘sell’ trigger in the MACD but today’s engulfing pattern of Friday’s intraday range is bullish.

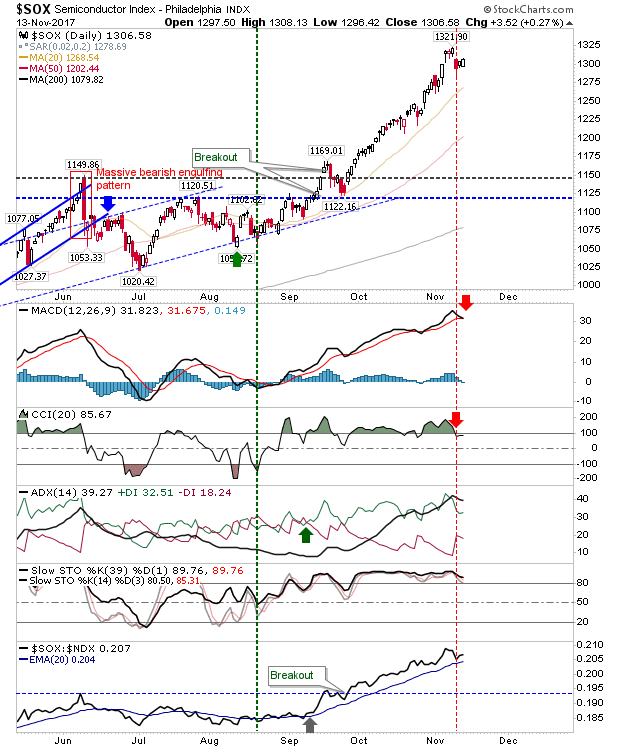

The Semiconductor Index is doing its best Bitcoin impression as it makes back some of last week’s losses. Technicals have started to weaken with ‘sell’ triggers in the MACD and CCI.

For tomorrow, keep an eye on the Russell 2000 and play for a bounce off support in the S&P.

If you are new to spread betting, here is a guide on position size based on eToro’s system.

Twitter

Leave A Comment