Gold got a boost Friday on weaker-than-expected inflation and retail sales figures, casting doubt on the Federal Reserve’s ability to continue normalizing interest rates this year.

Consumer prices rose slightly in June, at their slowest pace so far this year. The consumer price index (CPI), released on Friday, showed the cost of living in America rising only 1.6 percent compared to the same month last year, significantly down from the most recent high of 2.8 percent in February and below the Fed’s target of 2 percent. Much of the decline was due to energy prices, which fell 1.6 percent from May.

As I’ve explained elsewhere, CPI is an important economic indicator for gold investors to track. The yellow metal has historically responded positively when inflation rises—and especially when it pushes the yield on a government bond into negative territory. Why lock your money up in a 2-year or 5-year Treasury that’s guaranteed to give you a negative yield?

But right now the gold Fear Trade is being supported by what some are calling turmoil in the Trump administration. Last week the Russia collusion story took a new twist, with emails surfacing showing that Donald Trump Jr.; Jared Kushner, the president’s son-in-law and now-senior advisor; and former Trump campaign manager Paul Manafort all agreed to meet with a Russian lawyer last summer under the pretext that she had dirt on Hillary Clinton.

Whether or not this meeting is “collusion” is not for me to say, but the optics of it certainly look bad, and it threatens to undermine the president’s agenda even more. For the first time last week, an article of impeachment was formally introduced on the House floor that accuses Trump of obstructing justice. The article is unlikely to go very far in the Republican-controlled House, but it adds further uncertainty to Trump’s ability to achieve some of his goals, including tax reform and infrastructure spending. I’ll have more to say on this later

A Contrarian View of China

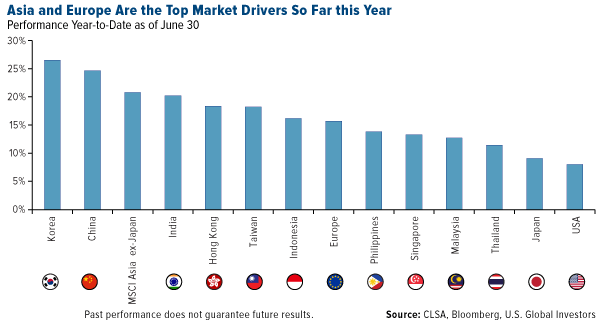

A new report from CLSA shows that Asian markets and Europe were the top performers during the first six months of the year. Korea took the top spot, surging more than 25 percent, followed closely by China.

Despite persistent negative “news” about China in the mainstream media, conditions in the world’s second-largest economy are improving. Consumption is up and household income remains strong. The number of high net worth individuals (HNWIs) in China—those with at least 10 million renminbi ($1.5 million) in investable income—rose to 1.6 million last year, about nine times the number only 10 years ago. It’s estimated we could see as many as 1.87 million Chinese HNWIs by the end of 2017.

Leave A Comment