S&P 500

During the day on Wednesday, the market rose significantly, reaching towards the 1950 level in order to find quite a bit of resistance. We ended up turning around as a result, and the market broke apart during the course of the day. In fact, we broke below the 1900 level, so now I believe that the market continues to drop significantly from here. We will more than likely try to test the 1860 handle, which of course was the area that the market tested back during the selloff in August of last year.

I think that it’s only a matter of time before rallies get sold off as well, because quite frankly this market looks horrible, and even more importantly than that the markets worldwide the look very negative overall. With that being the case, the market should continue to offer resistive candles on short-term rallies. I believe this will be the best way to work the S&P 500 over the next several sessions.

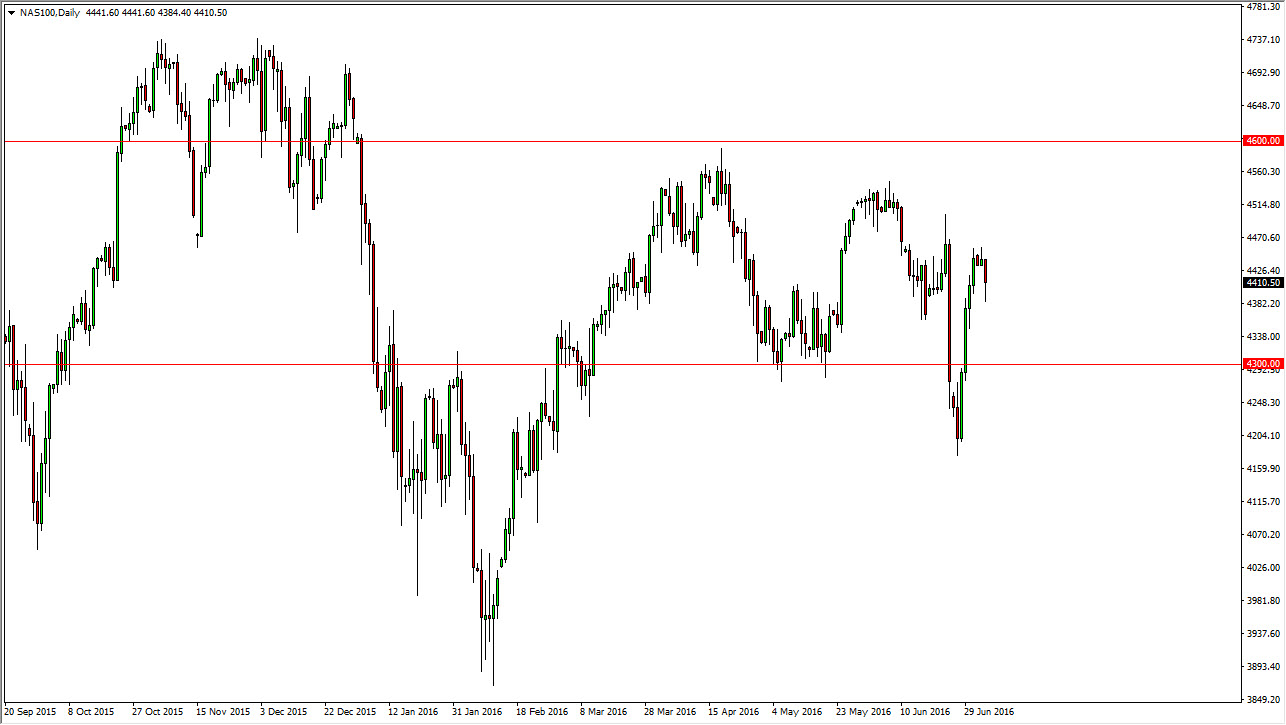

Nasdaq 100

The Nasdaq 100 initially tried to rally as well, but struggled to break above the 4360 handle, so the market ended up turning back around and breaking through the vital 4200 level. Because of that, the market should continue to go lower from here, and short-term rallies offer selling opportunities as far as I can see. I have no interest in buying any stock indices at this point in time, because quite frankly the situation worldwide is getting softer and people are starting to come more and more concerned.

I do recognize that we could get a bit of a bounce fairly soon, but given enough time the sellers will come back. Quite frankly, I do not believe that this market can be bought into we get well above the 4400 level, which is something that certainly isn’t going to happen anytime soon.

Leave A Comment