S&P 500

The S&P 500 initially fell during the day on Thursday, but found more than enough support near the 2020 level to turn things around and form a bit of a hammer. That being the case, the market then looks as if we are ready to go much higher, perhaps reaching for the 2060 level. I believe that on a break of the top of the hammer, more by orders will come into the market and push the S&P 500 in that direction. Even if we fell from here, I still believe that there is a massive amount of support near the 2000 handle, so we the way I have no interest in selling although I would admit that could throw me for a bit of a loop. Given enough time though, I feel that we reach the 2100 level.

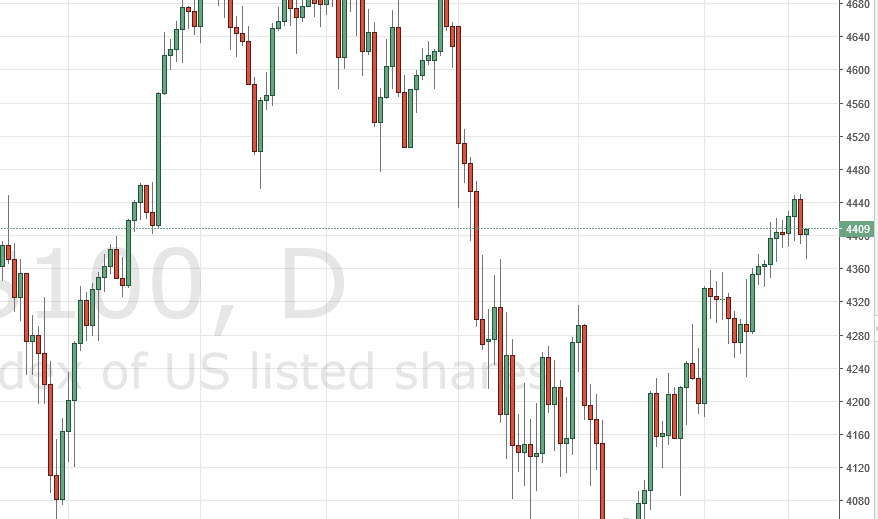

NASDAQ 100

The NASDAQ 100 did the same thing, initially falling to the 4360 level only to turn back around and form a hammer. So I feel that this market will continue to go much higher. Ultimately this market should then reach towards the 4500 level, and perhaps even higher than that. A pullback from here, perhaps even a break down below the bottom of the hammer, could of course happen but I think that would only attract value hunters as we have most certainly recently broken out above the 4350 level which was such a significant short-term barrier. With this, I feel that the NASDAQ 100 is picking up quite a bit of steam, and will eventually grind its way not only to the aforementioned 4500 level, but higher levels than that as the market will enjoy quantitative easing, or at least the Federal Reserve stepping away from a handful of interest-rate hikes that it could have done this year. With that, the NASDAQ 100 should continue to be a bullish market that you can buy on dips and of course breakouts.

Leave A Comment